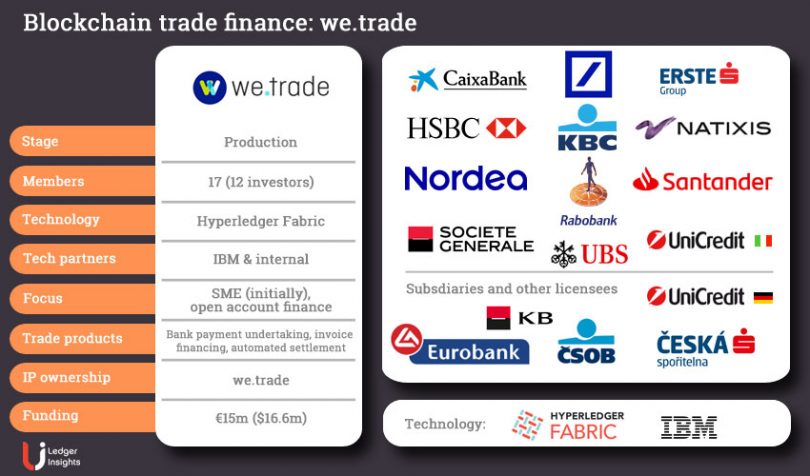

Blockchain trade finance firm we.trade recently told Ledger Insights that 55% of its transactions are automated payments. The firm is a joint venture between 12 major banks, including HSBC, Deutsche Bank, Santander, and Société Générale. Although it had a soft launch in 2018, banks started to roll out the service to clients last May, with the most recent CaixaBank launching its offering this month.

Given the primary business model is to offer invoice financing and bank payment undertaking, one could interpret the popularity of auto settlement as unfavorable. But it may be a big win for suppliers, banks and we.trade.

The trade finance platform tracks the supply chain process. So provided the goods are delivered, payment can be triggered automatically on the contractually agreed date.

we.trade is available to companies of all sizes, and has proven particularly popular amongst small and medium-sized businesses (SMEs), the size of company that bears the brunt of late payment world-wide. A recent UK survey found that a third of the SMEs experiencing late payment have to wait two months beyond the due date.

The European Late Payment Directive has had some impact, but not enough. Statistics for 2018 show only 42.8% of companies across the union respect payment terms, but that’s an improvement from 39% in 2016. There’s a wide variation between countries such as Poland (79.3%) and Portugal (14.2%).

Paying late is essentially using those suppliers as a source of finance. If the settlement is automatic and on-time, then the buyer might require more bank financing, a win for the banks.

And for we.trade, automated settlement is a strong selling point to encourage adoption of the platform. So much so, that we.trade is considering offering the service to banks for free for domestic payments in the Czech Republic. It’s then up to the banks what they charge their customers.

“If you look at a lot of tech companies, often they may have a freemium model and a premium model. We were looking at it in that context,” said Ciaran McGowan, we.trade General Manager.

Three of its member banks have a presence in the country, and together, they account for 80% of the market. They are Société Générale Czech affiliate Komerční Banka (KB), Erste Bank subsidiary Česká spořitelna and KBC subsidiary ČSOB.

Progress

Apart from the 55% of transactions being auto settlement, Bank Payment Undertaking accounts for roughly 27% of transactions and BPU financing 18%.

Additionally, we.trade revealed a sector breakdown, including 46% of corporates are from the industrial/manufacturing sector, 40% in clothing and apparel, and 5% in foods.

McGowan was quite upfront in saying he didn’t think they’d yet identified a sweet spot customer given the varied countries, company sizes and sectors. “I think the volumes need to get to a large enough scale before that will emerge,” he said. And he expects that to start happening later in the year after a set of new features have launched.

Ultimately we.trade is a software company. One of the typical KPIs is retention, and some one-off transactions would be expected. David McLoughlin, we.trade’s Head of Commercialisation acknowledged they have “what you might call frequent repeaters and occasional repeaters. And then the one-hit wonders.”

McGowan is particularly interested in feedback from one-off users, to find out how to turn them into regulars. Key demands are for an expansion of we.trade’s Trader Directory to Asia and ERP integration. For now, without that integration, companies need to upload their invoices to the platform.

we.trade’s roadmap

When it comes to the Trader Directory, customers don’t merely want to use the directory for finding partners. They also want to address negotiation discussions and agreement terms that tend to be spread over email, text and WhatsApp. The plan is to store these all in one place, a feature being developed internally at we.trade’s Dublin office.

In addition to upgrading the Trader Directory to include Asia, expanding we.trade’s partnerships in Asia is another roadmap item. It’s been more than a year since we.trade announced a relationship with Hong Kong’s trade finance blockchain eTradeConnect. But that was an initial technical proof of concept. There are ongoing discussions about full relationships with Asian trade finance platforms.

To expand territories, apart from the business model and technology, it’s necessary to extend we.trade’s “Rulebook,” which covers governance, legal and compliance issues. For Europe, McGowan commented that the Rulebook took more time than the technology. That’s a message we’ve heard repeatedly for financial applications.

Also on the roadmap is the ERP integration as demanded by customers, and enhanced security required by banks. we.trade has done a roadshow to visit the compliance departments of all 12 banks. McGowan believes that satisfying all their requirements will “further drive we.trade’s commercialization by the banks.” He expects to deliver that in a couple of months and the four road map items by the start of the third quarter.

He’s also targeting July for an upgrade to a more recent version of Hyperledger Fabric to allow both on-premises hosting and a choice of clouds.

The hosting impacts we.trade’s bottom line because that’s its highest direct cost. The level of dedicated hosting is the biggest factor in determining the annual licenses to banks with platinum, gold and silver offerings ranging from €50,000 ($55,500) upwards.

Growing the team

The other key resources are money and people. On the finance side, at just over €15 million, the funds raised by the company are slightly less than some other incorporated consortia. Despite this and the shortage of blockchain skills, McGowan says they’re not struggling to attract talent to we.trade.

McGowan was hired in part for his technical background to help to build an internal tech team. When he joined in April last year, the team was eight, and so far, the headcount is up to 24, and he expects that to grow to 32-34 in the next two months or so.

Dublin is home to numerous global high-tech companies, and where competitor Marco Polo is also building a team. “We benefit from being in a city where there is an abundance of talent available – and we feel we are probably punching above our weight in attracting this top talent,” said McLoughlin.

The full list of banks is CaixaBank, Deutsche Bank, Erste Bank and its subsidiary Česká spořitelna, HSBC, KBC, Natixis, Nordea, Rabobank, Santander, Société Générale and its subsidiary KB, UBS, and UniCredit Italy. Eurobank, CSOB and UniCredit Germany are non-shareholder licensees.

Hyperledger, the umbrella organization of several blockchain protocols including Hyperledger Fabric, is hosting its annual forum in March in Phoenix featuring numerous industry luminaries. Register by 18 February for a discount. Ledger Insights is a media partner.