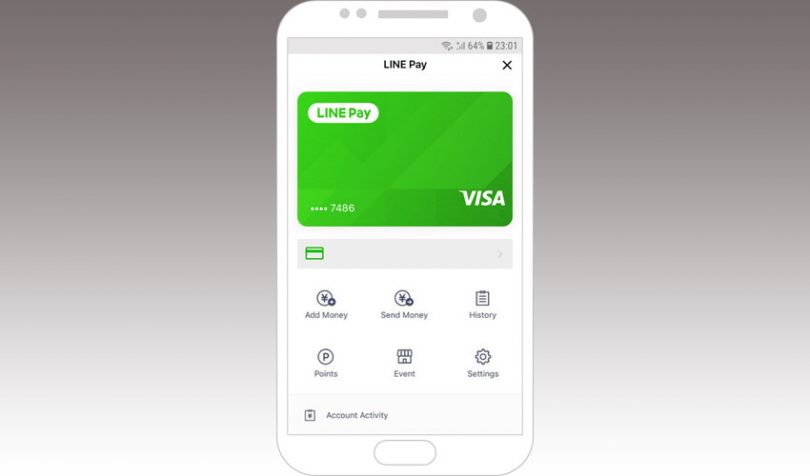

LINE, Japan’s answer to WhatsApp, has inked a deal with Visa to expand an existing relationship. The main news is that all of LINE’s 187 million users globally will be able to apply in-app for Visa cards. The blockchain angle is that LINE Pay and Visa plan to use blockchain for B2B and cross border payments.

Visa and LINE have an existing relationship where they offered co-branded cards in Taiwan, one of LINE’s major markets.

“LINE Pay is more than just a payment method. As we transition to a cashless society, LINE Pay is focused on delivering added value to LINE’s users around the world and business partners,” said Youngsu Ko, CEO of LINE Pay.

“The Visa co-brand program that currently serves 2.3 million customers in Taiwan is one of Visa’s fastest-growing programs globally, said Chris Clark, Regional President, Asia Pacific, Visa. “We are impressed by the potential of LINE’s distribution power and consumer loyalty to further drive the growth of the global, open-loop payments ecosystem to benefit all players on our network – consumers, merchants, and issuing and acquiring banks.”

Visa is pushing to use its own network as an alternative to SWIFT. It has its enterprise blockchain B2B Connect platform which targets high-value corporate payments. It also recently acquired UK-based Earthport to expand its cross border payment reach.

LINE is also active in blockchain. Last year it unveiled its own blockchain called LINK chain, where the LINK token is primarily used for rewards. LINE is growing rapidly with 2018 revenues of Yen 207 billion ($1.9 billion), up 24% on 2017. However, it made a 2018 loss of Yen 5.8 billion ($53 million). Less than 50% of LINE’s users are in Japan with the balance in Taiwan, Thailand and Indonesia.

LINE continues to invest in Line Pay, adding Yen 20 billion ($184 million) in capital just four months ago. Although LINE doesn’t split out LINE Pay figures, it has a segment that includes LINE Pay, other LINE fintech services, LINE Clova AI platform, blockchain related initiatives and e-commerce. The total 2018 revenues for the segment were Yen 9.2 billion ($84 million).