Highlights:

- Bank think tank worries some USDC reserves may be parked at the Federal Reserve

- BlackRock now manages the majority of USDC stablecoin reserves through a money market fund

- Reports claim BlackRock is applying to use Federal Reserve reverse repos (RRPs)

- The cashflows of RRPs are similar to depositing money at the Federal Reserve

The Bank Policy Institute, a bank-supported think tank, published a blog post raising concerns that a proportion of the USDC stablecoin reserves could be parked at the Federal Reserve, despite the stablecoin issuer not having a central bank account. If this were allowed, in times of uncertainty when there’s a flight to quality, this could result in bank runs diverting cash into the USDC stablecoin, which might be perceived as being as good as a central bank digital currency (CBDC).

Since November, BlackRock has been managing a large portion of the reserve assets of the USDC stablecoin on behalf of the stablecoin issuer, Circle. BlackRock created a bespoke money market fund, the Circle Reserve Fund, which invests in U.S. short-dated Treasuries. It currently manages around two thirds of the assets of the $44 billion stablecoin, which keeps 80% of its reserves in Treasuries.

A December research note from Barclays highlighted that money market funds can apply to use the Federal Reserve reverse repo (RRP) facility.

This involves the fund buying Treasuries from the Federal Reserve, which are resold to the Fed at a future date at a slightly higher price. The net effect of the cash flows is not dissimilar to depositing the USDC reserve cash at the Federal Reserve. The BPI called it a ‘backdoor CBDC’.

The BPI claims that BlackRock has applied for the RRP facility. It further asserted that 20% of USDC reserves currently held at banks could be shifted to the RRP program. After publication a Circle spokesperson told Ledger Insights via email, “In time, we expect that the Circle Reserve Fund will apply for access to the Fed’s RRP program. If access is received, we would have the option to move USDC cash reserves inside the fund and into the RRP program. We would also continue to maintain a portion of our cash reserves inside the regulated U.S. Banking system.”

The RRP route is potentially better than a synthetic CBDC. The latter involves a digital currency that is backed by a stablecoin issuer’s cash held at the central bank. This reduces counterparty risk because there’s no bank risk. However, the account still belongs to a private entity which means there is some risk, whereas the counterparty of the RRP is the Federal Reserve itself.

BlackRock and USDC for capital market transactions

BlackRock invested in Circle in April as part of a $400 million funding round. At the time, the asset manager said it was interested in using USDC for capital market transactions. But stablecoins are not viewed as a risk-free settlement asset. So the RRP would considerably improve USDC’s risk profile.

There’s generally a strong preference for using central bank money for securities transactions. Fnality is backed by 17 global institutions and is effectively creating a synthetic CBDC designed for capital market transactions. Some bankers not involved in the project see that as a good interim step but would still prefer to use a CBDC.

Why the Federal Reserve might refuse RRP access

Looking at the application process for the RRP, for starters, the Circle Reserve Fund would need to be operating for a year, so it won’t happen before November 2023.

A major hurdle for the Circle Reserve Fund could be compliance. The RRP application form asks about the proportion of shareholders in high risk sectors from an AML perspective. Given Circle is the sole shareholder and its involvement in the cryptocurrency and DeFi sectors, that would be 100%.

Is the RRP a temporary tool?

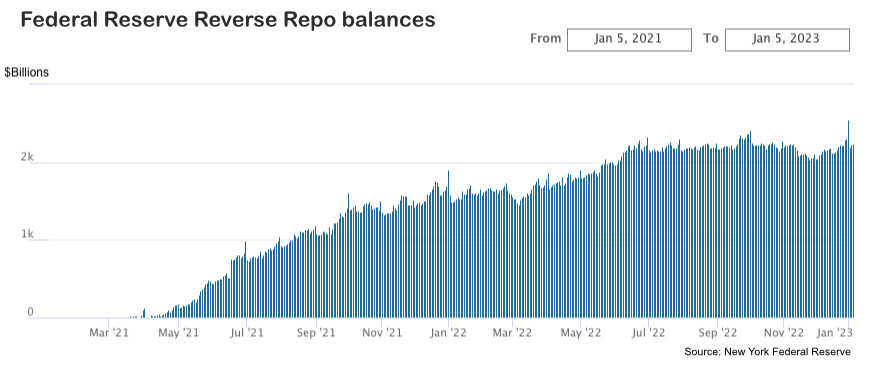

The BPI argues that the RRP was intended to be a temporary tool introduced in 2013. Between 2018 and May 2021 it was used occasionally with tiny balances. The current balance is $2.2 trillion. The spread between the interest rates on reserve balances and the overnight RRP rate is just 10 basis points (0.1%) and used to be 25 basis points. The BPI wants the spread to be reverted. “The Fed should not only deny Circle’s money fund access to the ON RRP facility, it should take steps to hasten the winding down of the facility as an attractive nuisance.”

A perspective beyond banks

Clearly, the BPI’s perspective is biased towards banks, although its concerns are not without foundation. If one accepts that stablecoins can provide utility, then there should be a desire to make stablecoins safer and more resilient. The RRP is one potential avenue to protect stablecoin reserves.

However, a key issue with stablecoins is the network effect. In other words, without intervention, there are likely to be only a handful of widely used stablecoins, or even perhaps a monopoly. While monopolies are highly desirable for the company, they are often suboptimal for the ecosystem. And for stablecoins, a monopoly or oligopoly introduces significant financial stability risks.

To encourage competition, the central bank might cap the figure that can be supported via RRP. Start low, say at $5 billion, and increase the cap as stablecoin adoption expands. If stablecoin issuers are forced to publicize the figure, then rational stablecoin users should migrate to stablecoins with a higher proportion of reserves ‘guaranteed’.

However, to date, crypto stablecoin users have not behaved rationally, as evidenced by the adoption of market leader Tether. If the proportion of mainstream stablecoin usage increases, perhaps that may change.

Update: added graphic of RRP balances and response from Circle.