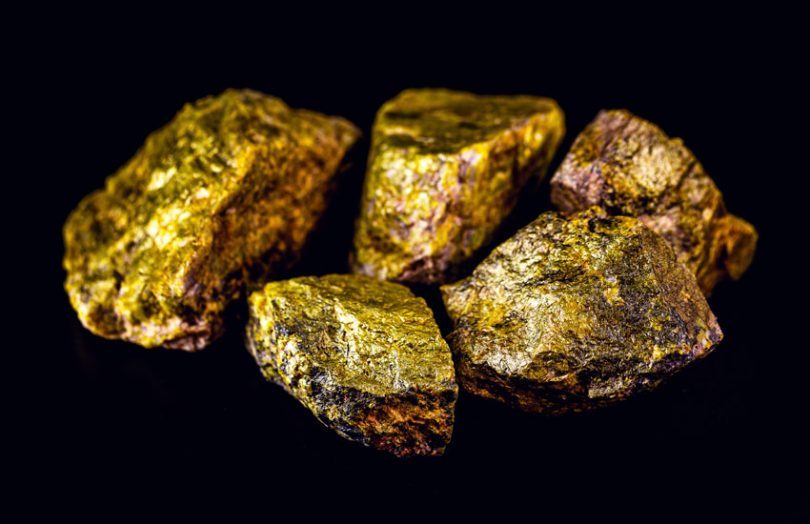

Earlier this week, blockchain firm Insolar announced a partnership with Canadian miner Uranium One to explore distributed ledger technology (DLT) for the Uranium market. The research project aims to enable improvements in both the supply chain and commodity trade settlement.

Uranium One is a unit of Russia’s Rosatom, the state nuclear energy company, and is one of the top uranium miners in the world. Currently, much like the rest of the commodities market, uranium trade is conducted using paper. Hence it’s inefficient and time-consuming.

A majority of the world’s uranium is produced by Kazakhstan, Canada, Australia, and Namibia. Owing to the sensitive nature of uranium trade, miners and traders have to meticulously furnish documents for cross-border transactions. Insolar said blockchain could be an ‘ideal solution to provide a trusted and standardized format, including shared governance’.

“We are exploring the potential that implementation of novel technologies can offer in very specific areas of our operations,” said Fletcher Newton, President of Uranium One Americas.

“A blockchain platform with advanced capabilities can significantly simplify trading activities in the market, meeting the increased requirements of market participants for security,” said Andrey Zhulin, CEO of Insolar.

Switzerland-based Insolar is an open-source blockchain platform and serves businesses in the supply chain and logistics, energy, retail and automotive sectors. Founded by a group of Russians, it ran an ICO in late December 2017 in which it raised $45 million. In February this year it launched its public Mainnet.

The company’s blockchain solution can be deployed as a public or private network.

Last year, Ledger Insight reported that Insolar was integrating its blockchain platform with the cloud services of Microsoft and Oracle.

Blockchain is revolutionizing commodity markets by providing a better audit trail and compliance. There’s also the opportunity to tokenize assets, and Russian commodities company NorNickel has plans to do so.

Canada’s Minehub has launched its supply chain blockchain platform for the metals and mining industry. The solution was developed with support from ING, Wheaton Precious Metals, Newmont Goldcorp, and others.

The World Economic Forum (WEF) has formed a mining consortium with Glencore, Tata Steel, De Beers and a few others. It aims to enable supply chain transparency and develop sustainability solutions for the metals and mining industry.

And IBM setup the Responsible Sourcing Blockchain Network (RSBN), initially focused on Cobalt, and includes Ford, VW, Volvo, Glencore and others.