In January new legislation came into force in the UK supporting a five year Digital Securities Sandbox (DSS) which temporarily relaxes some legal requirements to explore new technologies including DLT experimentation. Today the Bank of England and Financial Conduct Authority (FCA) opened applications for the sandbox.

In traditional markets, trading is conducted on an exchange and settlement via a central securities depository (CSD). DLTs are designed to combine the two functions and the sandbox supports that.

The bank emphasized that the rules in the DSS are flexible, allowing the regulators to make adjustments as they learn more. Financial instruments considered in scope include equities, corporate and government bonds, money market instruments such as commercial paper and certificate of deposits, fund units and emissions allowances. Derivatives and cryptocurrencies are excluded.

The regulators published guidance, a policy statement and an application form.

“The DSS lays the foundation for market participants to realise these benefits (of digital securities) in a safe, regulated environment and importantly, puts the UK in a strong leadership position when it comes to tokenisation,” said Quant CEO Gilbert Verdian. “With the EU having already launched its DLT pilot regime, it is vital that the UK does not fall behind in this new era of digital finance.”

That said, the DLT Pilot Regime hasn’t exactly gotten off to a flying start. More than 18 months have passed since the legislation came into force and regulators have not yet approved any applications. However, that’s expected to change soon.

Digital Securities Sandbox rule changes

The Bank of England and FCA ran a consultation for the Digital Securities Sandbox, which closed in late May.

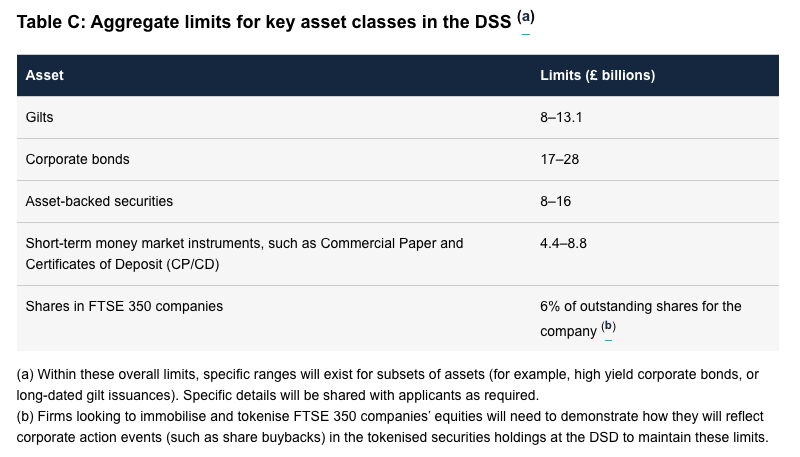

The regulators specified activity limits for the sandbox, the topic that attracted the most feedback from the consultation.

The global asset class figures remain unchanged (for the most part). However, the limits for individual firms have become more flexible. The DSS applicants will progress through a series of stages referred to as gates. Gate 2 is the go live stage and Gate 3 is the growth stage. If a firm hits its Gate 2 limits before Gate 3 applications open, it might be possible to have the limit revised. The individual firm ranges are:

- Gilts: £0.6billion–£1.25billion

- Sterling corporate bonds: £0.9billion–£1.5billion

We’re repeating the global figures from the consultation below:

Regarding fund management, in contrast to other asset classes, the regulators will not impose an aggregate limit on fund tokenization activity in the DSS.

Foreign currency assets now in scope

One of the most notable changes is the expansion of scope to include other currencies, such as euros and dollars. The regulators will specify global limits for these currencies, which will be in addition to the sterling limits. However, limits on individual firms will account for all currencies.

Regarding settlement, there isn’t a lot of movement. Stablecoins are still ruled out, with central bank money settlement considered the default. The Bank of England highlighted the availability of the omnibus bank account facility (as used by Fnality) and that it’s working with industry on an RTGS synchronization settlement facility. It said there was a possibility of wholesale CBDC experiments, but it didn’t make any promises. Settlement in commercial bank money is allowed, although it must be justified.

With long delays for approval under the EU’s DLT Pilot Regime, the regulators outlined expected timeframes. Gate 1 approval is quick (a month or so), but doesn’t mean much, particularly for unregulated participants. Banks that apply now can potentially be live by February 2025. For an unregulated entity, provided it makes it to Gate 2, go-live will probably be November 2025 or later. Other FMIs are somewhere in between.

Update: This article has been significantly expanded adding the section on rule changes onwards.