Today, the Bank of England and the Financial Conduct Authority (FCA) initiated a consultation regarding the UK’s five-year Digital Securities Sandbox (DSS). This initiative is designed to foster innovation by temporarily easing the requirements for central securities depositories (CSDs), enabling tokenization experimentation with distributed ledger technology (DLT) for digital securities trading and post trade.

Following a consultation conducted by HM Treasury last year, the DSS legislation was activated on January 8. The focus of the current consultation is on the operational specifics.

“The new Digital Securities Sandbox reshapes how we regulate by allowing firms to test regulatory changes using real world situations before these changes are made permanent,” said Sheldon Mills, Executive Director, Consumers and Competition at the FCA. “We hope this will be a more effective, collaborative and quicker way of delivering regulatory change.”

DSS volume limits are not generous

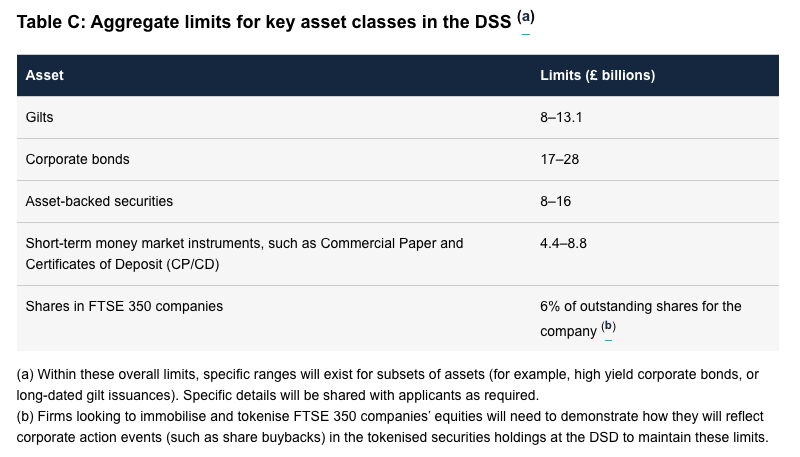

A critical area of interest is the potential volume limits for trading and issuance. The European Union’s introduction of the DLT Pilot Regime was met with skepticism by major players due to restrictive activity ceilings. Although the UK pledged more adaptable limits, in some instances, they may be significantly lower. The limits are there for a purpose – to ensure financial stability while rules are relaxed.

Unlike the EU, which set limits at the infrastructure and entity levels, the UK proposes market-wide limits to be shared among institutions. Therefore, the more participants involved, the tighter the restrictions on any single institution. The imposed limits might seem generous if the DSS encounters the same lack of popularity as the DLT Pilot Regime.

There were indications last year that larger UK institutions might enjoy higher limits. It now seems that the overall limit will be distributed equally among all participants, though this is part of the consultation.

Relaxations mainly impact CSDs

Participation is open to three types of entities: CSDs (or digital securities depositories, DSDs), trading facilities or hybrid infrastructures. Trading infrastructure rules remain the same, but the regulations for CSDs are significantly relaxed within the sandbox.

New entrants of any size as well as existing CSDs and exchanges are encouraged to join the sandbox. However, newcomers wishing to operate a trading platform must apply for an exchange license in the conventional manner.

Relaxation of CSD rules also extends to banks, allowing them to operate within the sandbox under the same legal entity as their commercial banking operations. It is likely that most CSD regulations will be reinstated once an entity exits the sandbox, referred to as the ‘end state’.

Outlined in the consultation document is a ‘glidepath’, which details the stages of participation: application, testing, and then proceeding to live operations at which stage a uniform volume limit is applied across each institution for each asset class. As volumes reach their upper thresholds, organizations can request to advance to the scaling stage. In the ‘end stage’ the entity emerges from the sandbox with revised legislation in place.