NFT and games startup Animoca Brands has completed a $65 million round of funding at a $2.2 billion valuation. In July, it raised $138 million at a $1 billion dollar valuation, including from Samsung.

Leading investors include Liberty City Ventures, Ubisoft Entertainment, Sequoia China, Dragonfly Capital, Com2uS, Kingsway Capital, 10T Holdings, Token Bay Capital, Smile Group, Tess Ventures, MSA Capital, Octava Fund, Adit Ventures, Summer Capital, Sigitech Holdings, Black Anthem Ltd, Mirana Corp, and Justin Sun.

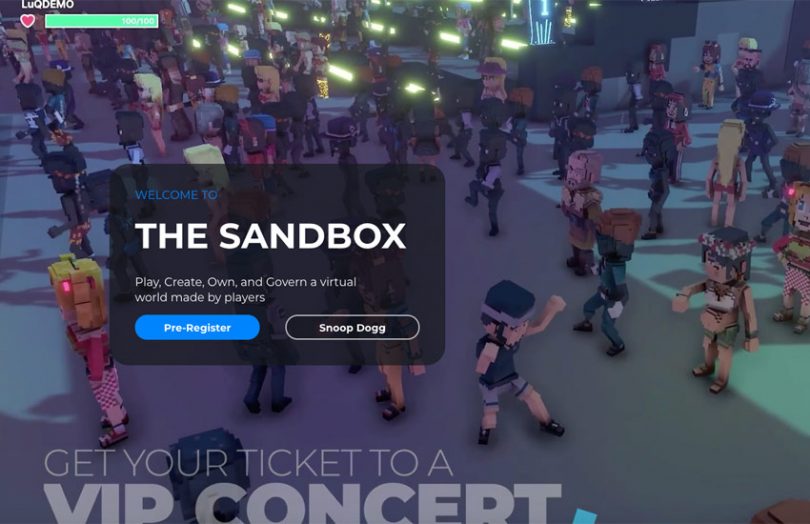

Initially, Animoca focused on building games such as The Sandbox, where the token has a market capitalization of more than $700 million. It also has a number of game and non-fungible token partnerships, including with the Olympics, Formula 1, Manchester City and MotoGP.

Additionally, in the past few months, Animoca has made a series of strategic investments in play-to-earn initiatives, non-fungible token (NFT)-based products, and other entertainment solutions that implement blockchain in their development. The company was previously known for its video game products, but its expanding investment portfolio has shifted Animoca to resemble a blockchain entertainment fund.

The additional funding will be used to expand Animoca’s portfolio, acquire and manage strategic intellectual property, and continue the product development of its existing games.

Play to earn

One of Animoca’s key areas of expansion is play-to-earn games. This genre of video games enables players to buy NFTs characters or tools using in-game cryptocurrency and use the digital assets to enhance their performance in the game and earn the game’s crypto. These tokens can then be exchanged for fiat currency or used to continue buying NFTs. In August, Animoca launched REVV Racing.

Besides investing in play-to-earn games, Animoca also invests in play-to-earn communities. These are groups of players that train other players in these games with the goal of being able to make a living wage. One of these communities, Yield Guild Games, has player mentors across various lower-income countries in Asia and South America. Animoca was one of the first well known companies in blockchain to invest in the group.

While Animoca invests in more niche and lesser known initiatives, its portfolio includes leading blockchain brands, including OpenSea, Dapper Labs, and Bitski.

“In 2018 we laid out a strategy based on our assessment that in the future digital property rights would revolutionize industries by expanding financial inclusion, and that this significant change would start with NFT adoption in games,” said Animoca’s co-founder Yat Siu.

“That future is already here. With the backing of our new strategic investors, Animoca Brands will continue to advance blockchain in gaming – and beyond – to introduce billions of gamers and Internet users to true digital ownership.”

Meanwhile, Galaxy Interactive, another fund specializing in the interactive industry, just raised a second $325 million fund. And Dapper Labs raised an additional $250 million at the end of September.