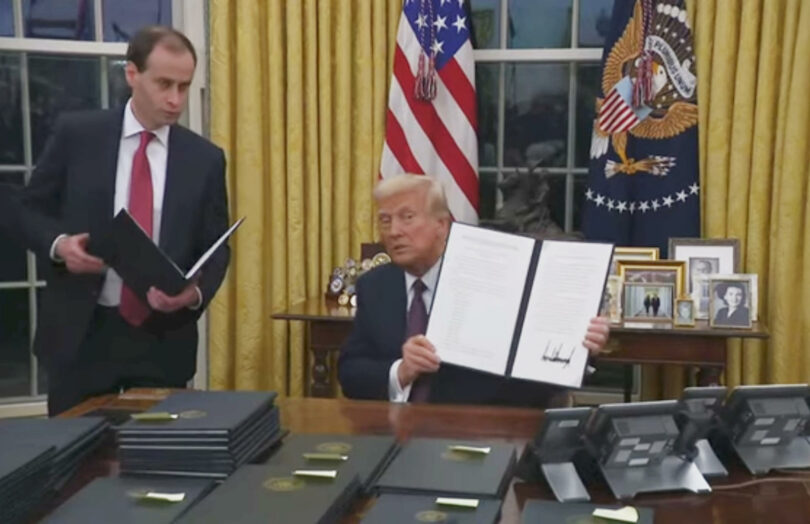

Yesterday the White House published President Trump’s executive order on digital financial technology. It creates a digital asset working group, which will be responsible for proposing federal regulatory framework within six months. White House AI & Crypto Czar David Sacks will chair the group, which consists of the heads of 11 government agencies. That includes the Treasury Secretary, Commerce Secretary, SEC Chair and CFTC Chair. Despite the regulations covering stablecoin payments, the Federal Reserve and other banking regulators are not included.

However, there is a caveat that the Chair can invite other agencies that have relevant expertise.

While the executive order includes evaluating the potential for creating a national digital asset stockpile, it states this will likely come from asset seizures.

The key actions of the executive order are to:

- allow access to public blockchains, for people to participate in validating transactions, and preserving self custody of digital assets

- enhance US sovereignty by promoting lawful dollar backed stablecoins worldwide

- protect access to banking services for all

- provide regulatory clarity for digital assets based on technology neutral regulation

- prohibit the issuance of a CBDC.

Additionally, the new order revokes President Biden’s digital assets executive order and the Treasury’s “Framework for International Engagement on Digital Assets.” The latter covered quite a bit of ground, with a substantial proportion relating to CBDC. It also involved working with the Financial Stability Board on digital assets, AML with FATF, and OECD work on crypto tax, amongst others.

Stablecoins in, banks out?

Apart from excluding banking regulators from the working group which covers stablecoin payments, it remains to be seen how wide the CBDC ban is.

On the stablecoin regulation front, the previous administration pushed for the Federal Reserve to be given a central role in approving stablecoins under draft regulations. Excluding the Fed from the working group is a big step in the opposite direction.

Sidestepping banking regulators is likely a backlash. They are viewed as obstructing the crypto sector through de-banking and there was pushback about the shutting down of Signature Bank by the FDIC. Digital asset bank Custodia has been repeatedly refused membership of the Federal Reserve System. That said, the FDIC now has a Republican Acting Chair.

Banks have also been slowed from engaging with blockchain and DLT. For example, the USDF Consortium for interbank DLT payments has not yet launched, even though it moved from a permissionless to a private blockchain. That’s apart from the many banks that were blocked from offering crypto to clients.

No wholesale CBDC?

Regarding CBDC, the ban does not distinguish between retail and wholesale CBDC. Unlike a retail CBDC where there are valid privacy concerns (even with the best of intentions), a wholesale CBDC is designed for interbank settlement only. The Federal Reserve already explored differences between a wholesale CBDC versus tokenizing existing central bank reserves.

Either of these would support banks engaging with blockchain, particularly for tokenized deposits, securities settlement and cross border payments. The lack of wholesale CBDCs has slowed bank adoption of DLT around the world. Recently the European Central Bank ran DLT trials for wholesale settlement using central bank money, which encouraged numerous (real) digital bond issuances. Sixty-four institutions took part in more than 40 trials and experiments.

The New York Innovation Center (NYIC) at the Federal Reserve Bank of New York has been involved (purely for research) in Project Agorá, which aims to make cross border payments via correspondent banking faster and cheaper. Agorá uses tokenization and is led by the Bank for International Settlements (BIS). Seven central banks and more than 40 private sector firms are involved, with most of the central banks providing a trial wholesale CBDC for interbank settlement. Without the dollar, that would leave a large gap for an international payments network.

The purpose of using central bank money for institutional settlement is to reduce payment risks. As a fallback, a private institution could tokenize the reserves held by multiple banks in an omnibus account at the central bank. From a risk perspective it’s not quite as optimal because there is always the risk of failure of the company, even if it is designed to be bankrupt remote. In the UK, Fnality has taken this approach. If the Fed itself is blocked from tokenizing reserves, Fnality’s U.S. expansion plans could be looking rosier.