Yesterday TradeShift announced it raised $250m at a company valuation of $1.1 billion. This brings the total funding to $400m. The company runs supply chain invoicing, marketplace, and payment solutions. Just last week it announced a blockchain based financing offering.

Goldman Sachs and Public Sector Pension Investment Board provided funding and also entered into new partnerships. Additional participation for this funding round comes from HSBC, H14, GP Bullhound, and Gray Swan, a new venture company established by Tradeshift’s founders. Existing investors include HSBC, Santander, CreditEase and American Express.

CEO Christian Lanng said: “Everyone gets that the future will be networked and that everything will be apps. It’s one of the reasons why blockchain seems to be getting so much traction lately. Blockchain is also a part of the digital zeitgeist, both a driver of and response to a global demand for greater trust and transparency.”

“The bigger idea is one we have been true to for eight years: supply chains of the future must run on a fully digitized platform of networked apps. Our Frontiers division, launched in January 2018, is focused on enabling supply chain applications for blockchain and other emerging technologies.”

One of the products provided by Tradeshift is a platform for large companies to manage their relationships with suppliers. So suppliers sign up and provide electronic invoices via the Tradeshift platform. It’s a cloud-based platform to interact with suppliers.

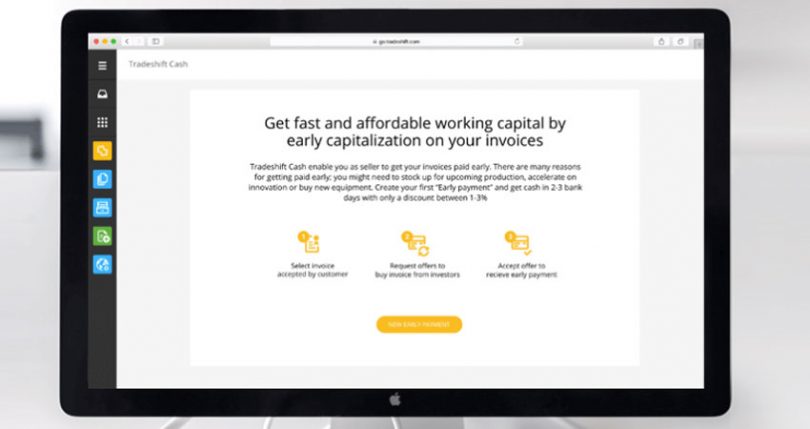

Tradeshift Cash

The blockchain related product announced last week is Tradeshift Cash. Targeted at SME and micro suppliers, the system provides an alternative to invoice factoring. Instead of waiting for payment, the supplier can ‘sell’ the invoice at a discounted rate to ‘investors’. Typically the discount is 2-5 percent, depending on the company’s business history.

Investors are significant banks such as Santander, HSBC, and American Express.

Lanng talking to CNBC said: “Banks used to be where the trade was. There’s a reason why there’s a bank branch at every single plaza and square in the world. Today all of that trade is digital. It’s on platforms like Tradeshift. If you’re a smart bank, you create a virtual branch (on Tradeshift).”

The suppliers will already have a track record as they have to be an existing Tradeshift user.

The supplier receives payment as soon as an agreement is reached with the investor. As with factoring, the supplier can’t sell the full invoice amount, but up to 70%. When the customer pays the invoice, it goes via Tradeshift which splits the payment. The investor keeps the agreed portion of the proceeds, and the balance goes to the supplier.

Invoice factoring difference

There are a few differences between Tradeshift Cash and conventional factoring, apart from the blockchain aspect. Firstly because both the supplier and customer use Tradeshift, everyone knows when the buyer has accepted the invoice. So there’s little risk of bill disputes for the investor, which is one of the most significant problems in factoring.

Secondly rather than just a single bank or company, there’s a pool of investors. Plus it’s a marketplace. So the supplier says which invoices he wants to sell and at what rate, the investor makes an offer, and the supplier can accept or reject it. Alternatively, if the supplier prefers, he can sell his invoices automatically.

Conventional factoring usually involves intermediaries who verify invoices and the like. Tradeshift cuts out the middleman, and typically charge a transaction fee of 0.1%.

Investors don’t see the full invoice. Since they know who the buyer is and that the buyer accepts the invoice, they only need to know the invoice amount and details about the supplier. A permissioned Hyperledger blockchain is used to store the primary data. It also saves details like proof a product has been produced sustainably. The fact that it uses blockchain won’t be evident to users.

The company does not use cryptocurrencies for payments, nor does it plan to for now. Lanng told Bloomberg “we need to see the next generation of currencies that are far more stable before that’s really relevant for the BtoB side of things.

Why blockchain?

What’s unclear is why a blockchain is needed. Centralized databases are far more efficient than blockchains. Blockchains usually replace a centralized organization. They help with trust if players in an ecosystem don’t want to trust a single organization, like Tradeshift. However, Tradeshift already stores all this data, so they could just provide a cut-down view to the banks.

Bloomberg’s Emily Chang asked Lanng: “There’s a concern that you attach the term blockchain to any company and the valuation goes up. Some have suggested that your valuation wouldn’t be sustained necessarily on the public markets.”

Lanng responded: “We’re a very fast growing SaaS company. Our valuation is backed by our revenues. Investors like Goldman Sachs, PSP, they’re very savvy. I don’t think they invest without making sure these things are where they need to be.”

“We’re very comparable with other companies that are trading right now. I feel pretty good about where we are. It’s not like we attached blockchain and became a blockchain company.”

“We’ve been working with global payment and transactions for the last eight years. We have a very long track record of doing this. So it’s not like we emerged yesterday and attached that. And our trade volumes are already bigger than Ethereum and Bitcoin combined.” The company handles more than $500bn in trade for its clients.

There are several companies active in this space, and we’ll be covering this sector in more detail.