A new asset and wealth management survey by PwC appears to show differences in appetite between asset managers and the institutional investors that they serve. That particularly relates to digital assets and tokenization.

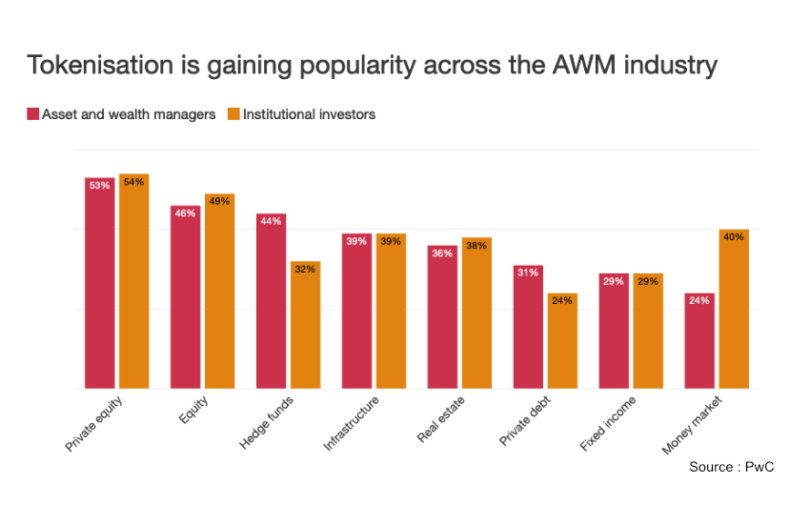

One of PwC’s questions explored which sectors institutional investors are interested in when it comes to tokenization. The biggest gap was money market funds, despite the topic grabbing plenty of press headlines. While 40% of institutional investors hold or plan to hold tokenized money market funds, only 24% of asset managers offer or intend to offer them.

In two other areas, asset managers may have overestimated investor interest: the tokenization of hedge funds and private debt. Asset managers consider private debt as a desirable area (31%) for tokenization, but it looks like there’s less interest from investors (24%). Both asset managers and investors agreed that the most attractive sector for tokenization is private equity.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.