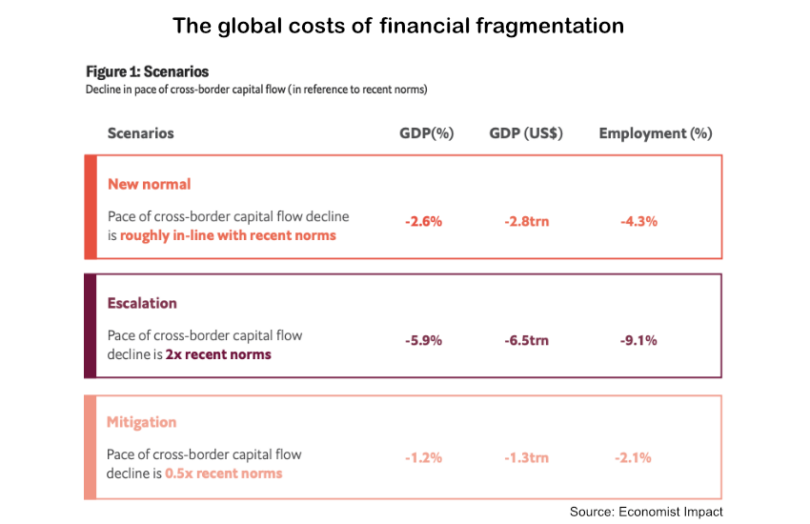

The Economist Impact has published a report on the cost of global financial fragmentation, sponsored by Swift. Based on the current trajectory of sanctions and trade barriers, the resulting financial fragmentation is expected to globally cost $2.8 trillion or 2.6% of GDP. If the negative trend escalates (doubles), the cost could be $6.5 trillion. However, it’s also possible that steps could be taken to mitigate the fragmentation, which could reduce the impact to $1.3 trillion.

For example, that might involve a drive towards more common global standards that lower transaction costs or greater interoperability between fragmented financial systems. The report identifies decentralized finance as offering some potential to provide alternative avenues to create new opportunities.

The reason for writing about this report is precisely because of the increasing fragmentation we’re seeing. Innovations such as stablecoins, tokenized deposits and CBDCs could all have societal benefits but also increase fragmentation during their transition.

Something not specifically covered in the Economist report is mBridge, the new cross border payment system being developed by China, Hong Kong, Thailand, the UAE and Saudi Arabia. When Russia starting publicly talking about BRICS Bridge, the Bank for International Settlements (BIS) dropped mBridge like a hot potato, because it can’t be seen to be involved with sanctioned payments.

On the point of interoperability addressing fragmentation, just days before the BIS withdrew from mBridge, China started talking about potentially integrating Swift with mBridge. In many ways, there’s no reason not to. A key driver of mBridge is to have a system in place if sanctions ever hit. And of course they can benefit from the efficiencies that DLT offers. With its current participants, why shouldn’t mBridge also integrate with Swift? However, if Russia or Iran got involved, Swift wouldn’t be able to engage.

Which economies are impacted most?

Coming back to the report, it identified which economies would be impacted most. In all scenarios, China was by far the biggest loser, which makes sense given its dependence on global trade. In an escalation scenario, it would lose 10.7% in GDP. The United States would suffer the fourth biggest decline, coming in around half the impact of China. The number two and three countries were more surprising, in South Africa and Kenya.

A lot of that is to do with the impact of fragmentation on foreign direct investment (FDI). “South Africa, for example, relies heavily on external capital flows to hold up national investment levels and capital stocks,” the authors state. “The real economy would falter in the event of a withdrawal of foreign equity and real-asset investment.” Between 2018 and 2022 FDI averaged around 1.3% of global GDP. That’s down from 3.3% in the early 2000s. They estimate that BRICS and emerging markets will come out worse compared to the G7.

It would be easy to quibble with some of the findings in the report. Especially the classification of countries as West versus East leaning, or neutral. Brazilian academic Carolina Moehlecke is quoted as saying, “A more fragmented world in terms of trade and finance is a poorer world, especially for emerging markets.” Now that’s harder to argue with.