Today the Bank for International Settlements (BIS) Innovation Hub published a report on Project Inthanon-LionRock Phase 2, the cross border central bank digital currency (CBDC) project between the Bank of Thailand and the Hong Kong Monetary Authority (HKMA). Following on from Phase 2, the People’s Bank of China (PBC) and the Central Bank of the UAE have joined the initiative for Phase 3, now known as the mCBDC Bridge project.

However, the Phase 2 report said three central banks were involved, without mentioning the third bank. Clearly, HKMA and PBC have a close relationship.

The report concludes that the project can significantly reduce cross border payment costs. At the same time, it found some areas that need further exploration, including privacy for PvP transactions, optimizing liquidity savings, and scalability.

Supplanting correspondent banking

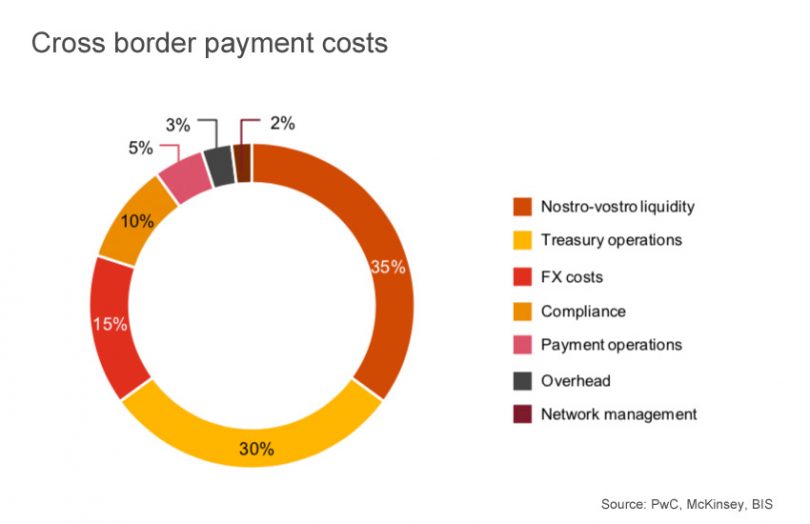

From the start, the goal of the project has been to address the cross border inefficiencies introduced by the correspondent banking network. Banks have to deposit cash balances all over the world to make payments, the Nostro-Vostro liquidity requirements. In countries where they don’t have accounts, they have to use correspondent banks as intermediaries. The combination raises costs and complexities and adds delays, particularly if there are anti-money laundering (AML) queries.

In recent years as the cost of AML compliance has increased, the number of correspondent banks has declined worldwide, making cross border payments tricky in some regions.

By tokenizing money, the money and the message move together, removing the need for correspondent banks as intermediaries.

The project involves iterating a new cross-border payment infrastructure that will reduce dependence on correspondent banks. In turn, this helps to meet one of the G20 goals to reduce frictions in cross border payments.

Reducing costs

Phase 2 of the trials has proven that cross border payments can be made in near real time and reduce correspondent banking costs by up to half.

A liquidity savings mechanism is used to manage liquidity algorithmically, yielding significant savings over typical Nostro-Vostro liquidity costs. Treasury operations costs are reduced because correspondent bank intermediares are removed and sharing the same data reduces reconciliation issues. Foreign exchange costs and compliance costs are also curtailed.

Significant parts of the functionality revolve around the liquidity savings mechanism (LSM) and foreign exchange transactions. In the case of the LSM, it used a hybrid model combining a typical real time gross settlement (RTGS) solution with a Deferred net settlement (DNS) system.

There were multiple options for foreign exchange transactions, including request for quote (RFQ), the use of board rates posted by participants, or arrangements made outside of the platform.

Technologies

In the project, the central banks operate the nodes that validate transactions, and commercial banks can host standard nodes or connect via APIs.

Phase one of the project used independent wholesale CBDCs for domestic use with Depository Receipts for cross border transactions. It used R3’s Corda enterprise blockchain with cryptoBLK as the main technology partner.

For the second phase, Ethereum development house ConsenSys was contracted to use enterprise blockchain Hyperledger Besu in a permissioned fashion with multiple CBDCs on a single platform. PwC consulted on the project.

Conclusions

While the takeaway from the project was a very positive one in terms of time and cost savings, some issues were highlighted that need further investigation.

The solution enables privacy, but in some cases, that privacy conflicts with the desired functionality. For example, preserving privacy between jurisdictions prevents atomic PvP. And if no single entity can see all the pending transactions, the liquidity savings mechanism is sub-optimal. Additionally, if a large number of validator nodes are added as the number of jurisdictions expands significantly, there’s a question of scalability.

The roadmap for phase 3 addresses these issues and others. It will also explore multi-ledger solutions, linking with core banking systems and other payment systems. And it will explore a path to production.