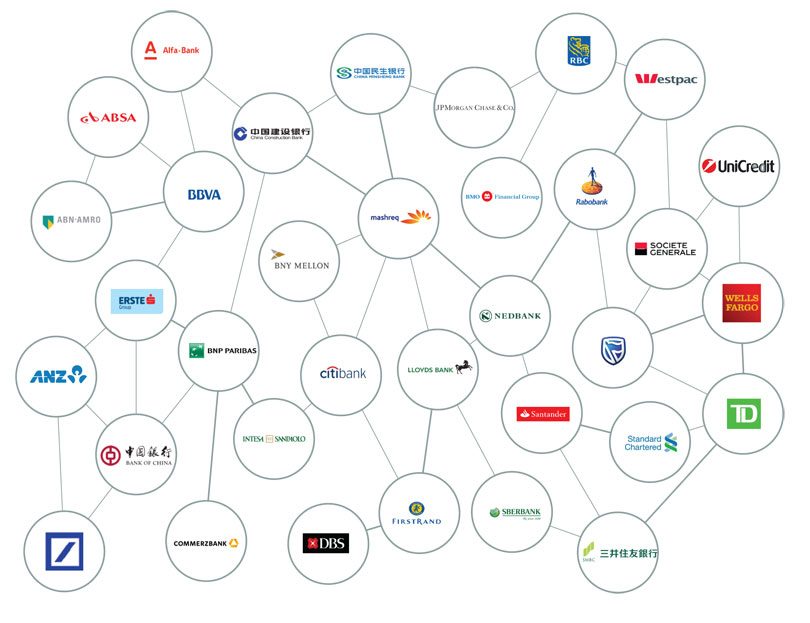

Today SWIFT, the interbank payment company, published the results of its DLT proof of concept (POC) with 34 participating banks.

On the whole, SWIFT announced it a success but also identified the work yet to be done before it could be used in production.

“The PoC went extremely well, proving the fantastic progress that has been made with DLT and the Hyperledger fabric in particular”, said Damien Vanderveken, Head of Research and Development at SWIFT. “The DLT sandbox enabled us to control access, to define and enforce user privileges, to physically segregate confidential data and store it only with the relevant parties while supporting a strong identity framework by linking all participants to their BIC, and having all keys signed by a SWIFT certification authority”.

The POC enabled:

- Real-time event handling

- Transaction status updates

- Full audit trails

- Visibility of expected and available balances

- Real-time simplified account entries confirmation

- Identification of pending entries and potential related issues

- Generation of data required to support regulatory reporting

Work to be done

Firstly many banks currently operate on a batch basis rather than a real-time basis. So they’d need to upgrade to be able to participate. Additionally, there is a standardized data model that would need to be adopted by all banks.

On the Hyperledger Fabric side, there is a need to be able to scale more. For example, while 528 channels were required in the PoC to ensure Nostro accounts would only be stored on the nodes of their account servicers and owners, to productize the solution, more than 100,000 channels would need to be established and maintained, covering all existing Nostro relationships, presenting significant operational challenges.