The Stanford Graduate School of Business has published its 2019 report on blockchain for social impact. Executives of 110 organizations in sustainability, identity, financial inclusion, governance, agriculture, and health were asked how they used blockchain. An overwhelming 93.5% of them said the technology added value towards their social impact goals.

The report follows on from last year’s research in the same area. Both projects were led by Doug Galen, a lecturer at Stanford and co-founder of RippleWorks. He and the other researchers aimed to discover where blockchain can be used most effectively to improve society.

Ken Weber, Ripple’s head of social impact, said: “While still early in its development, blockchain is an undeniably promising new technology with far reaching consequences across a wide variety of sectors and use cases.”

Participating firms included GrainChain, TE-FOOD, the Energy Web Foundation, ConsenSys, Trusted Key, Nebula Genomics, and Ground X. The report found that 51.9% of executives said blockchain is a necessity for their social impact goals, while 41.7% said it added value.

Another interesting finding is that most firms use blockchain for records and verification (47.3%) and platforms and marketplaces (26.4%), while the least common use case is smart contracting (1.8%).

“This is perhaps because this pain point is the largest among organizations in the [social] space, and they have found that blockchain is a reliable and accurate way to address the challenges of records and verification,” the report explained.

By sector, however, the use case distribution is more telling. The 23 agribusiness firms reported supply chain (43.5%), records and verification (43.5%), and platforms and marketplaces (13%) as their primary blockchain use cases.

Meanwhile, the 16 climate and environment focused interviewees said their use cases were mostly platforms and marketplaces (62.5%), followed by payments (18.8%). This ratio flips to 39.3% payments then 35.7% platforms when considering financial inclusion firms, which also cited records and verification (21.4%) as blockchain applications.

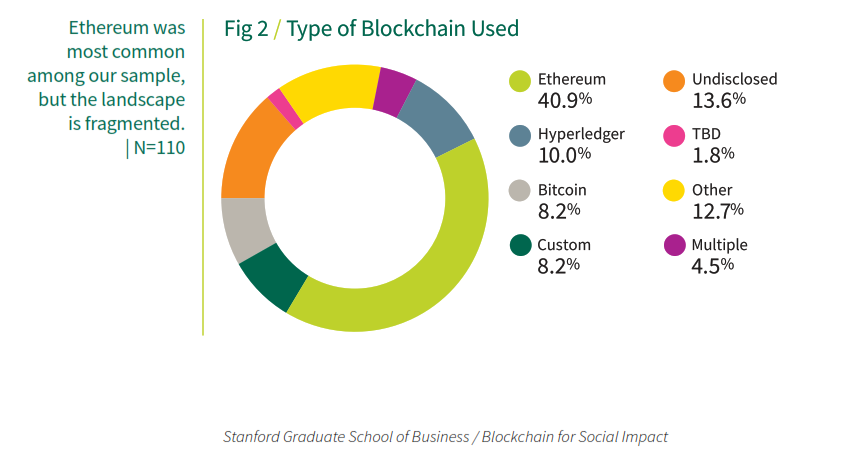

Less surprising is that Ethereum had the largest share (40.9%) of the socially focused firms, with Hyperledger coming in second (10%):

The Stanford researchers discovered that the biggest challenges facing these firms are regulations and getting a project up and running. They suggest that “government regulations are not adapting quickly enough to properly incentivize and facilitate growth in the blockchain-for-social-impact space.”

What about the sector where blockchain could be most effective? Ken Weber said: “In particular, it is exciting to see the progress being made by applications of both blockchain and digital assets as a means to accelerate and expand global financial inclusion – and to realize a more participatory and equitable vision of globalization overall.”