In a new report from Standard Chartered and its affiliate Zodia Markets, the authors predict that stablecoins transaction volumes will grow from the 1% of US M2 transactions they represent today to 10%. They also expect them to present 10% of foreign exchange (FX) transactions. Rather than giving a date, they say it will be driven by U.S. regulation. Additionally, they propose that stablecoins could be used by non-US traditional finance (TradFi) investors to address foreign exchange challenges raised by the US move to T+1 for equity settlement. They’re not just proposing it, they are trialing it.

Zodia Markets was founded by Standard Chartered’s SC Ventures. It launched in 2022 as a crypto brokerage and exchange, but pivoted to an over the counter (OTC) FX settlement solution for cross border payments involving stablecoins. By the middle of this year it was trading $50-$60 million a day.

Hence, the T+1 experiments make sense.

The T+1 challenge

The shift from two day settlement to one day settlement (T+1) for US securities is challenging for foreign investors, particularly those in APAC such as Australia, Hong Kong and Singapore. Given the time zone differences, they have to come up with dollars to pay for investments pretty quickly, effectively requiring FX on a T0 (same day) basis. But FX doesn’t settle on a T0 basis, so a workaround is required.

There are several ways to address these issues: Asset managers can instead execute via custodians, passing on the issue to them. Or they can set up in a location where the time zone isn’t so challenging. Or they can pre-fund their FX requirements.

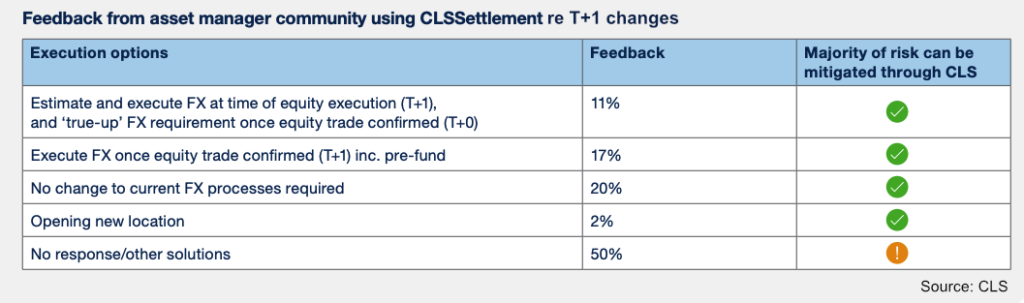

Beyond the StanChart report, we note that foreign exchange central counterparty CLS surveyed asset managers on the topic and found a mix of responses. But they didn’t separate their results by region, despite acknowledging that Europeans are far less disadvantaged compared to APAC. CLS average daily volumes have continued to climb since the move to T+1, but again it’s hard to know from which region.

One statistic is noteworthy. The CLS cut off is midnight central European time (CET). After the T+1 transition, in July and August 2024, the T+1 values between 7pm CET and midnight increased by 42% compared to the six month period to March 2024.

Stablecoins for FX settlement

Given stablecoins settle instantly, they can provide the T0 FX that APAC asset managers need. And they are not constrained by the working hours of any particular jurisdiction.

Zodia Markets has conducted experiments with Cumberland (the DRW digital asset subsidiary) between US dollar (Circle’s USD) and Australian dollar (Novatti’s AUDD) stablecoins. A key point is the FX trade was made outside of Australian business hours.

Cumberland and Zodia are planning other demonstrations, including settlement at weekends, pure FX settlement as payment versus payment, and using other currencies. We’d also note that some APAC regions are leaning into digital currencies, such as Hong Kong and Singapore, although Singapore is more cautious.

We’d add a couple of points to those raised by the report.

Many central banks are not keen on stablecoins for various reasons, particularly run risks, because they don’t maintain their peg 100% (singleness of money) and the variable quality. But the reality is stablecoins can provide a solution today.

There are other DLT TradFi options that might also be viable, such as the Partior DLT settlement network that can provide 24/7 instant multi-currency settlement. In fact, Standard Chartered is one of its backers.

However, Partior also carries some risk, because the settlement banks that form the core of the network have to settle up between themselves.

One of the neat things about Standard Chartered’s SC Ventures is they let their startups, such as Zodia Markets, compete with the parent bank. In fact, that’s sort of the point. If you’re going to be disrupted, it’s better if you own the disruptor.

Ledger Insights has published a report exploring the use of DLT by banks for payments, including cross border payments and FX.