Today Circle, the company behind the USDC stablecoin, announced a new SPAC agreement with Concord Acquisition Corp, the NYSE listed special purpose acquisition company (SPAC). The previous July 2021 agreement valued the startup at $4.5 billion, but the fresh deal puts a figure of $9 billion on the company.

A lot has happened in the sector in the last few months. Circle’s market share has substantially increased with the USDC current market capitalization above $52 billion, double the figure in July. Its market share is also significantly higher. That’s in part because of the continuing debate about the quality of the backing assets of competing stablecoin Tether.

While Tether continues to be heavily used for cryptocurrency trading pairs, USDC tends to be the stablecoin of choice for decentralized finance (DeFi), particularly lending.

However, cryptocurrency lending products are now officially considered securities, following the SEC settlement with crypto lender BlockFi. As a result, Circle might need to revisit the status of its Circle Yield offering.

Additionally, the President’s Working Group recently published its stablecoin report, which was debated in the last week in both Congress and the Senate. The Treasury wants stablecoin issuers to become “insured depository institutions”, and Circle already plans to become a bank.

Meanwhile, today’s statement said a key driver for the new deal was that the existing arrangement could not be finalized by 3 April 2022, “for a variety of reasons outside of the parties’ control”. The new transaction is targeting a date by 22 December 2022, with a possible extension to the end of the following January.

“We continue to believe that Circle is one of the most interesting, innovative and exciting companies in the evolution of global finance and we believe it will have an historic impact on the global economic system,” said Bob Diamond, Chairman of Concord Acquisition Corp and CEO of Atlas Merchant Capital. “Circle’s rapid growth and world-class leadership are underscored by a regulatory-first mindset fixed on building trust and transparency in global markets.”

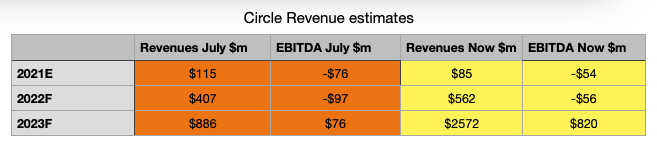

The figures released alongside the announcement show a massive increase in estimated bottom line profits in 2023. That year’s EBITDA was forecast as $76 million in July, but the latest estimate is $860 million. One slightly surprising piece of data is that top-line revenues for 2021 are lower than predicted at $85 million compared to July’s estimate of $115 million, despite the ballooning circulation of the USDC stablecoin.