A Southeast Asian payments survey commissioned by Visa shows the increasing shift to a cashless society. Two thirds of survey respondents showed an interest in using crypto for payments.

Cryptocurrency for payments

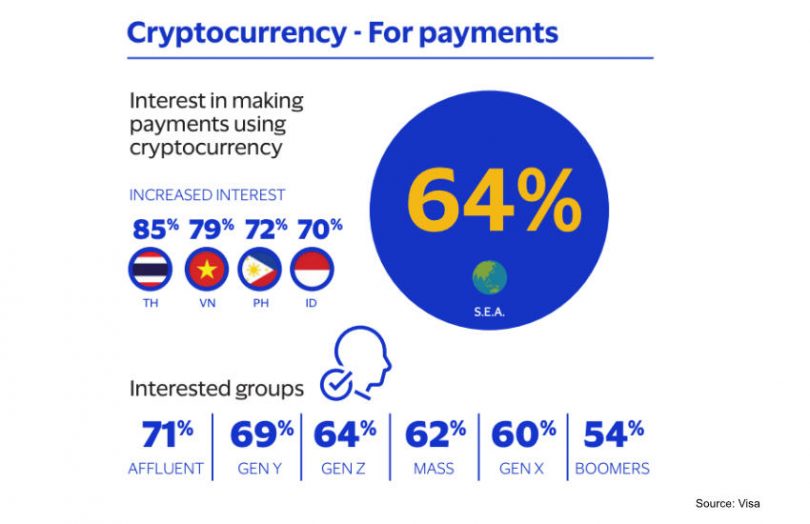

Visa canvassed a willingness to use cryptocurrency for payments, with almost two thirds of Southeast Asian consumers saying they’re interested. Leading the group was Thailand, with an 85% interest in crypto for payments, followed by Vietnam, the Philippines and Indonesia. While Thailand might be the keenest on crypto for payments, it imposed a ban on using digital assets for payments in March of this year.

The leading motivations for using digital assets for payments are convenience and novelty, followed by the potential to earn rewards.

Awareness of cryptocurrency was 92% across South East Asia, with 22% investing so far. Consumers in the same four countries are the keenest to invest, all scoring above 60%. This contrasts with Singapore, where just 32% are interested and 24% in Cambodia, which has the poorest economy among the seven nations. Singapore’s authorities have been very vocal about the risks of cryptocurrency.

Southeast Asia goes cashless

Of the seven countries involved in the research, the richest is Singapore, with 97% of people using cashless payments sometimes, compared to 68% in Cambodia.

While Cambodia ranks as the least enthusiastic regarding attitudes towards going cashless, the surprise is that Singapore is second from the bottom across the board. That applies to intentions to use cashless more often, views on its safety, and a preference for shops that access cashless payments. Despite that, the vast majority of Singaporeans favor cashless.

Cash usage is declining, with 57% of Southeast Asian respondents saying they are using less cash since COVID-19, with only Singapore (43%) and Cambodia (33%) reporting figures below the average. However, 86% of survey respondents in all countries still use some cash, with 32% saying it’s their preferred method.

A major event in Cambodia during this period was the launch of the Bakong, a new digital currency payment system operated by the central bank. This likely was why Cambodia reported the most first-time mobile banking users among the seven countries.

First-time mobile wallets outstripped new users of other digital payment methods such as contactless cards, online cards, and QR payments. Indonesia, the Philippines and Vietnam led the way with above average scores.

More than 6,500 people were canvassed for the survey by CLEAR during August and September 2021.

Visa also recently published a report on central bank digital currency (CBDC) policy.