Yesterday the Monetary Authority of Singapore (MAS) announced the completion of the first phase of its Global Layer One (GL1) initiative for tokenization and released a report. GL1 is envisaged as a public permissioned DLT network developed by regulated institutions for use by the financial industry. When the concept was first shared, BNY Mellon, JP Morgan, DBS and MUFG were announced as participants. DBS has been dropped with Citi and Societe Generale Forge now involved.

“This initiative could accelerate the modernisation of legacy systems through interoperability, increased asset mobility, and new business models,” said Puneet Singhvi, Global Head of Citi Digital Assets. “The future establishment of the GL1 Org would mark a key milestone in developing this vision through private-public dialogue and broad engagement around open standards.”

The idea of a shared ledger for regulated institutions is not new, with the Regulated Liability Network being the first, followed by the Unified Ledger and the IMF’s XC concept.

We’ve already seen the industry develop various DLT offerings using a variety of technologies. It’s possible to make them interoperable, but one of the key promises of blockchain was to address silos. It’s about more than just the different technologies but also the (lack of) standards. Composability across blockchains is far messier and more complex than a shared ledger, not to mention the downsides of fragmented liquidity pools.

These are the reasons why there’s a need for a shared ledger. So what makes the GL1 different?

How is GL1 different?

Part of GL1’s differentiation is the emphasis on composability, which means that one application can leverage another. By definition this requires various use cases to be deployed on the same network. One of the most obvious ones is collateral because this is the most interconnected. Tokenized securities issued via other applications make up the collateral. Collateral can be used as margin for trading or lending of various types of assets.

GL1 also wants to merge the full range of activities into the same ledger. To date many institutional DLTs have focused on issuance. Instead, GL1 also wants to support trading, settlement, payments, collateral, corporate actions and more on the same network. Additionally, it envisions the network supporting multiple asset classes rather than restricting itself to a single one.

One of the key pillars will be the development of common standards. There are a few proposals for tokenized securities. From the Ethereum community, there’s ERC 1400 and ERC 3643. The DTCC’s Securrency developed a framework from a more traditional finance background. It’s possible that the addition of SocGen Forge as a GL1 member was driven by its CAST security token framework, which it first released in 2021.

One key differentiator of GL1 versus the Unified Ledger is it embraces DLT. The BIS is on the fence so far.

What’s been done? What’s next?

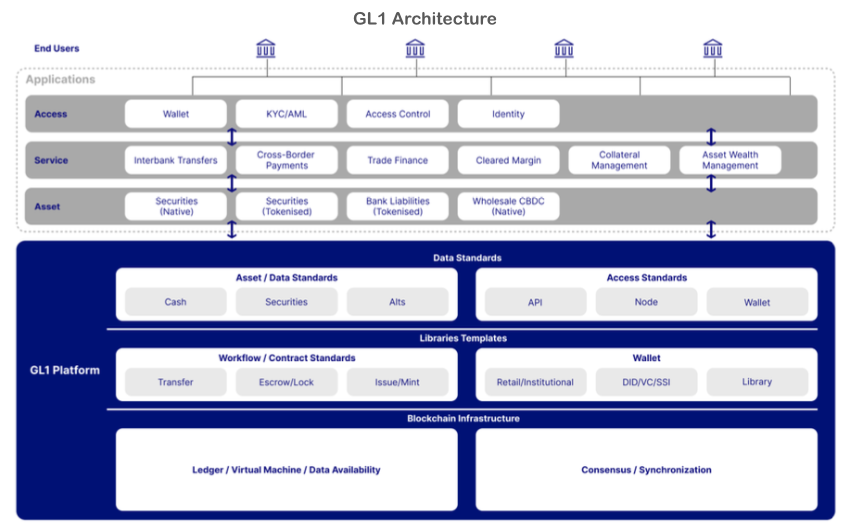

To date the discussion has mainly been around business use cases, governance, policy and design, including the need for identity and privacy. From an architectural point of view, it borrowed from the IMF’s Digital Asset Platform model of ASAP, which includes Access, Services, Assets and Platforms.

GL1 is positioned as an industry utility and will earn money from subscription and transaction fees. The platform will be run by operating companies that may have to qualify as financial market infrastructure service providers in certain jurisdictions.

One of the aspects we liked was the willingness to embrace some disruption. For example, it recognizes the potential of DLT and atomic settlement to eliminate the need for key roles performed by central securities depositories (CSD). However, it remains to be seen whether banks will be quite so disruptive of their own functions.

In the next phase, GL1 will look at setting up a nonprofit organization to operate the network. At the same time it will explore practical governance issues, including the mix of members, operating model and fees.

The technology challenge

GL1 plans to use a single DLT technology and has already done a preliminary assessment. However, to date institutions have mainly invested in three or four different DLTs: Ethereum/Besu, Canton, Corda and to a lesser extent Fabric. Hence, institutions that have financially committed to different technologies might choose not to join. Canton and Corda each have their own networks.

Based on the banks involved in GL1 so far, we’d be shocked if the conclusion wasn’t to opt for Ethereum/Besu. At least three of the five are very committed to the technology (Citi, JPM, SocGen). We don’t know what technology BNY Mellon uses, though we know it has dabbled with Canton. MUFG has mainly used Corda but is also making its platform interoperable with Ethereum-compatible public networks for stablecoin applications. In other words, we can think of some die-hard Canton and Corda users, but they’re not represented in the membership.

Besu’s biggest advantage is that it’s compatible with many public blockchains and hence also has a significant developer base. However, other solutions have superior support for privacy (certainly) and scalability (to some extent). An alternative would be to get a service provider to do a neutral assessment. Even that could be challenging, as many have a preferred DLT technology, although we have one or two in mind.

Stepping back, a shared ledger is the way to go. Interoperability is a vastly inferior second choice from an efficiency and opportunity perspective. That means it is necessary to pick one technology. However, as we noted when the concept of a Regulated Liability Network was first proposed – if the network gets disrupted, then much of the world’s financial system will go down. That’s an awfully attractive target for hackers.