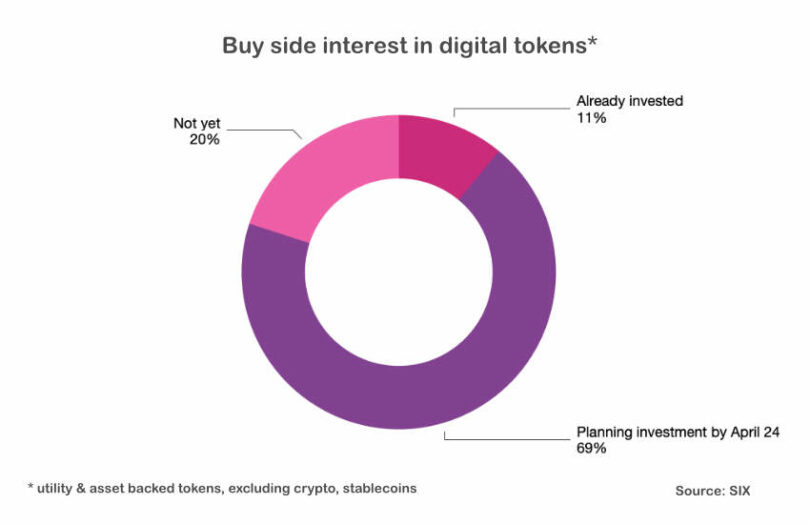

Last week SIX published the results of an April survey of buy side firms covering digital assets and other topics such as ESG. It found that just 11% of respondents currently held ‘digital tokens’ but another 69% plan to invest within the year. Digital tokens were defined as asset backed tokens or utility tokens but excluded crypto, stablecoins or CBDC. The survey covered 300 asset managers, wealth managers and hedge funds around the world.

The biggest adoption driver was seen as technological advancements, but SIX classified several other motivations as increasing confidence. These include reduced counterparty risk, more exchange traded products and more regulated trading venues.

Of those that already trade digital tokens, only 54% currently trade on regulated marketplaces.

Lack of conventional custodians is a blocker

The European Investment Bank (EIB) has issued four blockchain bonds. Unrelated to the survey it sees the need for more traditional custodians as the number one factor currently holding back digital asset adoption. That’s because investors prefer to deal with their current custody providers.

Likewise, the SIX survey found that 55% of respondents said they would be more willing to participate if the assets were held by a conventional custodian.

SIX has its SIX Digital Exchange (SDX) for digital assets. So it’s no surprise that it asked about the importance of a regulated exchange in the entire digital assets sector, including crypto. The key roles were seen as increased transparency (42%), followed by greater growth potential (32%) and mitigating counterparty risk (21%).

Meanwhile, SDX is participating in central bank digital currency (CBDC) trials for the Swiss Franc. The Swiss National Bank is issuing a real wholesale CBDC onto the SDX exchange for a limited time window.