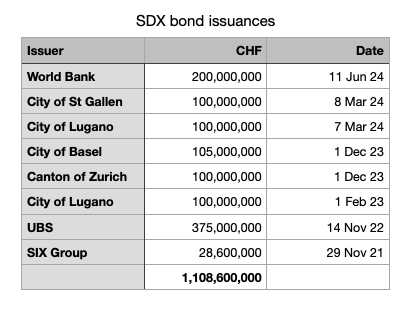

Last week the World Bank priced a CHF 200 million digital bond to be issued on the SIX Digital Exchange (SDX). With the latest issuance, the first regulated digital securities exchange will surpass CHF 1 billion ($1.1 billion) in issuances.

The Swiss National Bank’s wholesale CBDC pilot, Project Helvetia III, has played a pivotal role in the recent success of the SIX Digital Exchange. The pilot, which was exclusively launched on the SDX platform, was a factor in attracting the World Bank.

Before the launch of the Helvetia pilot, there were just three multimillion franc bonds over two years. They were from the SIX Group, UBS, and the City of Lugano. With the World Bank’s bond, this will be the fifth issuance in six months. All five used the wholesale CBDC for settlement.

SDX – a series of world firsts

SDX has led the way for the institutional sector on several dimensions. It was the first regulated digital securities exchange in the world. Additionally, it was the first to integrate the digital central securities depository (CSD) with a conventional CSD. Plus, it is the only platform to use a live wholesale CBDC for settlement so far.

The UBS CHF 375 million bond issuance in November 2022 was the largest digital bond issuance until Hong Kong issued one twice the size earlier this year. More importantly, the UBS bond was the first to support the interoperability between the central securities depositories (CSDs) of SDX and the main SIX stock exchange (SIS). Critically, this means the bond is capable of trading on the main SIX exchange. A bond of that size would not have been feasible without that integration.

“Breaking through the 1 billion barrier underscores the growing acceptance and adoption of digital assets within the global financial landscape,” said David Newns, Head of SIX Digital Exchange. “Our objective has always been to seamlessly connect digital and traditional infrastructure, mitigating market fragmentation and facilitating the efficient transition to digital assets.

“The digital bonds issued to date remain open to the entire investor base as they are listed, traded and settled both on a regulated digital exchange and traditional market infrastructures.”

Being the first is never easy, especially if it requires institutions to integrate with your platform. Take the inaugural issuance by SIX Group before the CSD integration between SDX and SIX SIS. SIX announced a CHF 100m digital bond combined with a CHF 50m conventional bond. While the issuance totaled CHF 150m, only CHF 28.6m was ultimately on the digital exchange.