Swiss stock exchange owner SIX in its recent Trader Survey found that a majority of participants were interested in digital assets.

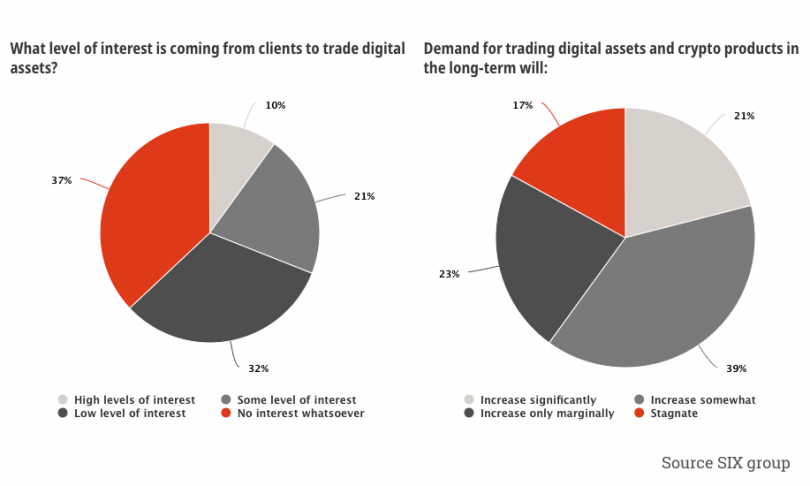

The survey included 126 respondents from across Europe, of which 80% believe that demand for trading digital assets will increase in the future. Only 21% of respondents said that the demand would stagnate in the coming years.

SIX found that about 13% of the traders were receiving high levels of interest from clients to trade digital assets, while about 41% said clients showed some level of interest. Many traders feel digital assets will streamline the trading and settlement process and reduce overall trading costs.

“The Swiss Stock Exchange is already making significant headway in digital assets, as the world’s leading regulated marketplace to trade products with crypto-currencies as underlyings,” said Tony Shaw, Executive Director, London Office and Head Sales UK & Ireland in the Business Unit Securities & Exchanges at SIX.

SIX is already quite active in the digital asset space and has taken the lead with some key partnerships. It is currently developing its SIX Digital Exchange (SDX) for one-stop issuance, custody, trade and settlement of digital assets. While a prototype of SDX was launched last year, a finished platform is expected to be released late this year.

SDX is based on R3’s Corda blockchain and takes some of its features from the Swiss Stock Exchange. The main benefit is the near-instant settlement of trades, eliminating the risk of payment defaults and avoid leveraging the services of a central counterparty, reducing costs.

Digital assets provide benefits such as liquidity and allows companies to raise money from practically anywhere. Due to lower costs, the barrier for entry is also reduced. Additionally, investors can hold fractional ownership by leveraging digital assets.

A few months ago, SIX announced plans to list tokenized shares of Nestle and Novartis on SDX. The platform was initially focused on big enterprises to drive traffic on the exchange. However, its recent partnership with Swisscom might widen its target audience.

Last month, SIX announced it invested in SME share registry and tokenization firm daura, a unit of Swisscom.

Before this collaboration, Swisscom was working with Singapore’s Sygnum Bank, Deutsche Börse, digital asset custodian Custodigit and daura. Two months ago, Deutsche Börse and Swisscom completed a blockchain proof of concept to settle securities transactions using both tokenized shares and cash.

However, with the partnership of SIX and Swisscom, a dual effort for digital assets in Switzerland was merged, with Deutsche Börse informing it will look for similar opportunities in other EU countries.

By combing forces with Swisscom, SIX is well poised to offer digital asset services to SMEs as well as big enterprises.

Among other initiatives, tokenization firm Securitize has been making news by securing investments from some high-profile players. These include SBI Holdings, Santander InnoVentures, Mitsubishi UFJ Financial Group (MUFG) Innovation Partners, Nomura Holdings, Ripple, Blockchain Capital and Coinbase.

Meanwhile, Japan’s SBI Group is also collaborating with Boerse Stuttgart to develop a blockchain-based digital asset ecosystem in Europe and Asia. The Stock Exchange of Thailand is building a blockchain-based digital asset platform, which is expected to go live this year.