Today the Monetary Authority of Singapore (MAS) published its stablecoin regulatory framework following a consultation it ran last year. The rules apply to single currency stablecoins issued in Singapore in the Singapore dollar or any of the G10 currencies and that have a value of more than S$5 million.

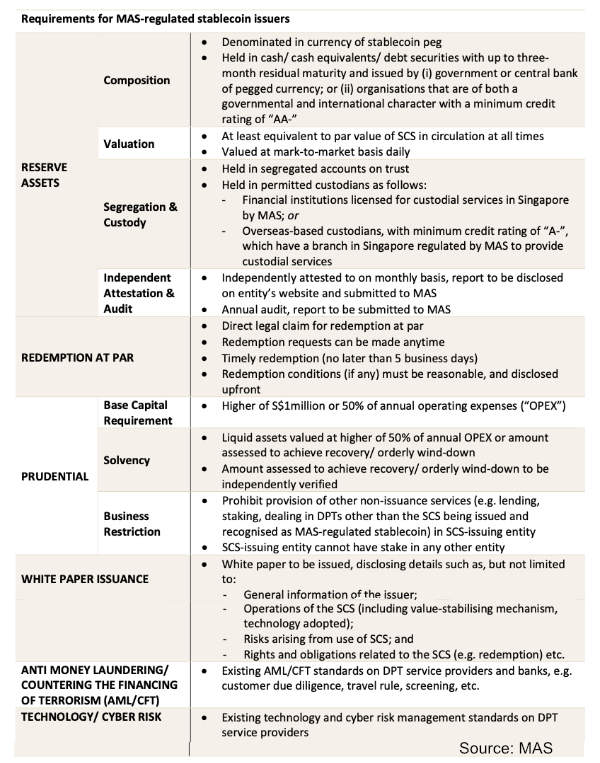

The framework has the caveats one would expect regarding stablecoin reserve management, monthly third party attestations, the capital of the issuer, stablecoin redemption, and disclosures. A few highlights are worth noting.

The regulator will allow compliant stablecoins to use the “MAS-regulated stablecoin” label, but this will only apply to tokens that are issued only in Singapore. Foreign-issued stablecoins will continue to be allowed to be used in Singapore subject to the Digital Payment Token (DPT) legislation. Stablecoins in non-G10 currencies can also be issued within Singapore outside of the framework. One of the reasons they are not initially included is that it’s tricky to ensure these currencies have sufficiently liquid backing assets.

Bank issued stablecoins

Given banks are already regulated, one of the questions was whether banks would be subject to additional regulation. The answer is no. However, this only applies to bank issued stablecoins that are equivalent to those that fall within the new framework.

MAS acknowledged that tokenized bank balances do not have the same risk characteristics as stablecoins and hence are excluded from the stablecoin framework. “MAS may impose additional requirements on tokenised bank liabilities in the future as necessary,” it wrote.

Stablecoin redemption within five days?

One of the requirements – that (direct) issuer redemption is within five days – appears rather lax at first glance. However, the consultation response document clarifies that this takes into account market stress periods, presumably when liquidating backing assets might incur a loss. “In normal business conditions, redemption should be expedient and not delayed unnecessarily,” MAS added.

Limitations on issuer stablecoin activities

Stablecoin issuers cannot get involved with trading, staking or lending where interest is paid to customers. And MAS emphasized that stablecoins do not have deposit protection. The issuer can participate in incidental services such as custody of the issued tokens and enable the transfer of stablecoins to buyers. However, the issuer cannot have subsidiaries or other outside corporate investors. These rules are intended in place of a “comprehensive risk-based capital regime.”

That said, a sister company can be involved in any of these activities, provided the issuer has no ownership interest in the firm.

Meanwhile, in the United States, stablecoin legislation is progressing, although the Democrats are unhappy about the current status, implying that the legislation could be vetoed by the President unless it morphs.