Today at SIBOS, as part of an innovation panel, three venture capitalists were asked to describe what money might look like in 2040. The presentation by Matt Harris of Bain Capital Ventures was the most radical, extending features already seen in decentralized finance (DeFi) and envisioning it dominating the future model.

Two judges awarded points to all three of the presentations, but the third, SIBOS’ Head of Innovation Thomas Zschach, opted in full for Harris’ vision. Zschach said a significant factor was that Harris picked one path rather than outlining options.

Harris didn’t pull any punches. “By 2040, we will largely be done with the bad trade that is fiat currency, where we give our capital for free to the government, for the privilege of having it diluted by the tax of inflation,” he said.

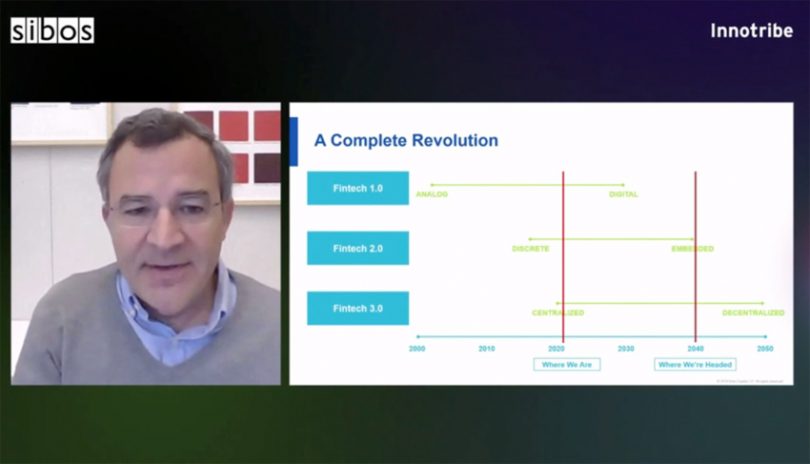

“With the mainstreaming of crypto and web 3, the final piece of this complete revolution has snapped into place,” said Harris.

The road ahead

He outlined three fundamental changes in financial services, starting from the shift from analog to digital, followed by the work in progress evolution from discrete products to embedded services. And finally, the disruptive change from centralized platforms to decentralized networks.

Harris listed multiple challenges that need to be addressed for this vision to take hold, starting with establishing identity at the point of every transaction, even if that’s pseudonymous.

Today in DeFi, with the yield farming concept, crypto-assets can be automatically moved between various pools to maximize a return. Likewise, in 2040 Harris envisages algorithms and protocols will sweep excess money from one place to another in real-time.

In some countries, when you go to pay in a physical store today, you may be offered a physical cash withdrawal. In 2040, a retailer might give the option of paying later or depositing money to earn a return.

“Our assets will be 100% invested at all times, but still entirely linked through the mechanic of stablecoins,” said Harris.

While all these pools of deposits and wallets might seem overwhelming, automation will eliminate the hassle.

Harris pondered how governments and financial institutions will transition from here to there. “I know what I hope, which is that they embrace it. And don’t start a new cold war on the government side, and don’t lean into enhanced regulation,” he said. As an aside, Bain Capital has an investment in centralized crypto lender BlockFi which is currently receiving scrutiny in multiple U.S. states.

Revolution not evolution

One of the judges noted that historically technologies had not displaced each other but rather been layered on top.

“I’ve been an incrementalist my whole career. I work at Bain Capital. I’m not a radical revolutionary,” Harris responded. “And it is only recently frankly through watching and investing the last four years in decentralized finance, that I’ve come to the conclusion that that historical pattern you mention of layering and evolution is actually no longer going to be the pattern.”

“That decentralization in its fullest flower actually overthrows what came before.”