A survey about cryptocurrencies’ criminal risks had a surprising finding. When financial institutions were asked whether cryptocurrencies should be considered legal tender – as in stores are required to accept them as payment – 44% of respondents said yes.

The survey was conducted by YouGov on behalf of the UK defense think tank Royal United Services Institute (RUSI) and anti-money laundering education body ACAMS. It carries even more weight because ACAMS is headed by the former Executive Secretary of the Financial Action Task Force (FATF).

Asked about the prominent uses of cryptocurrencies, as a first-choice pick, financial institutions (FIs) reckoned that 50% of people use them for investment or speculation, with 35% for illicit purposes and the remaining usage as payments. In contrast, the crypto industry put investment at 81% and illicit use at 2%. Government respondents were in between with 62% thinking investment and 26% illegal purposes.

The same question was posed, but with a timeline of five years in the future. The crypto sector put first choice usage for payments as 63% with investment as the balance. FIs selected payments as 38%, investment as 37% but still believe 26% will be for illicit purposes.

The report authors concluded that cryptocurrency firms may be underestimating the types of threats posed. And that FIs and others are likely overestimating the degree of criminal activity.

There was a contrasting perspective on cryptocurrency firms preparedness for dealing with cybercrime, with 48% within the sector believing they’re prepared but only 9% of FIs agreeing with that.

Perceptions about the traceability of cryptocurrencies also showed a gulf. Eighty-three percent of the crypto industry believes that cryptocurrency is more transparent than traditional transactions. Whereas 63% of FIs disagree. If you think about it from a crypto perspective, anyone can do the tracing, and then you need to speak to one exchange to convert pseudonymity into a real name (if an exchange was used). For a fiat transfer, banks already know real names. On the other hand, banks can only follow a payment trail with which they were involved. Anything more requires additional effort.

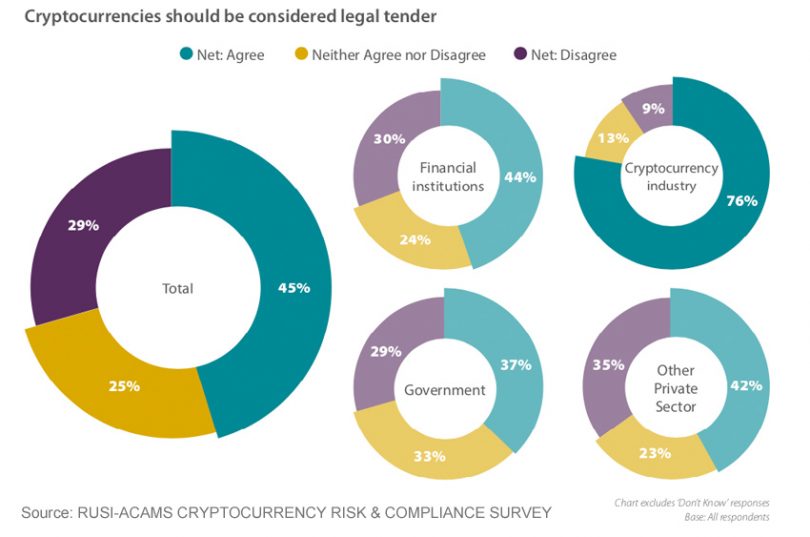

One of the most novel questions was whether cryptocurrencies should be considered legal tender. Naturally, 76% in the crypto sector thought so. But a surprisingly high figure of 44% of financial institution respondents agreed and 37% from the government. But then surely the question would be: which ones? Because there are plenty that are rather illiquid.

The report noted that on many issues, there was little regional difference. However, when FIs were asked whether cryptocurrency was easier to use than fiat currency, 43% of Asians agreed, versus 15% for Europe and 9% for the U.S.

Perhaps it’s no surprise that China is likely to become the first major economy with a digital legal tender.