U.S. asset manager and administrator SEI plans to participate in the UK’s Digital Securities Sandbox (DSS) alongside Ctrl Alt, which has applied to be a direct participant. SEI will provide the assets to be tokenized within the sandbox, which is a joint initiative from the Bank of England and the Financial Conduct Authority (FCA). The DSS will explore the potential to relax certain regulatory requirements for DLT-based financial market infrastructures.

While SEI might not be a household name, it has $1.6 trillion in assets under management and administration and has a market capitalization of almost $9 billion. It is the world’s largest private credit fund administrator by assets. That’s a sector that is viewed as ripe for tokenization.

“Tokenized solutions have the potential to enhance security, transparency, and efficiency to drive significant improvements across financial services,” said Sneha Shah, Head of New Business Ventures at SEI. “Building upon our roots in innovation and leveraging our ability to connect the industry in ways that others cannot, we’re committed to unlocking benefits across the entire asset lifecycle and value chain through this collaboration.”

As part of the collaboration, SEI is investing in Ctrl Alt. The startup offers two tokenization products. One is a special purpose vehicle structure to act as an asset wrapper for tokenization, SPVS 3.0. The other is a fund tokenization solution, Funds 3.0, which targets asset managers that want to issue funds on a blockchain natively, rather than tokenizing an existing fund.

Current laws for financial markets require a central securities depository to be used for secondary trading transactions, and also enforce the separation between the trading venue and post trade. These are two of the key areas where the DSS relaxes some laws.

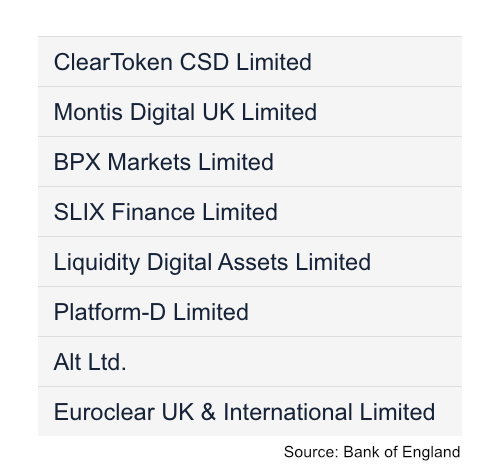

Digital Securities Sandbox entrants

The DSS has a gated system for entrants, with Gate 1 a very preliminary step that doesn’t necessarily mean the entity will pass Gate 2, which allows transactions in the sandbox. Existing regulated institutions are expected to progress through approvals faster. So far eight organizations have passed Gate 1, including Euroclear. That’s five more compared to our last report in late January. No organizations have yet been approved to start transacting.