Ripple and enterprise blockchain firm R3 were previously involved in litigation over an options agreement that granted R3 the right to buy five billion XRP. A critical detail about the confidential settlement reached in September 2018 was leaked in SEC legal papers filed against Ripple on Tuesday.

The pertinent detail is that ‘an enterprise software firm’ exercised an option to buy 1.04 billion XRP in 2019. Given we don’t know precisely when R3 sold the tokens, that puts the settlement between $240 million and $470 million.

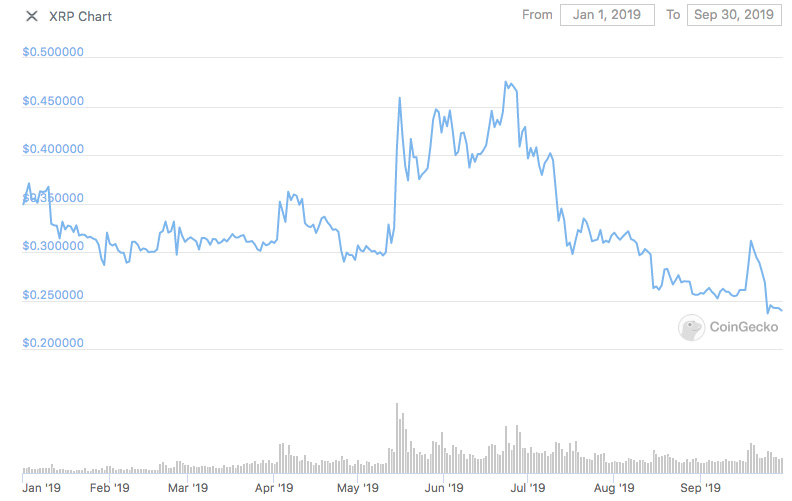

The XRP price range for the year to the option’s expiry in September 2019 was 24 cents to 47 cents, with most of the time around 30 cents. If 1.04 billion was exercised at the 24 cent low, the settlement figure would be $240 million. There was a dip in the XRP price in late September.

The Ripple R3 dispute related to R3’s allegedly unfulfilled marketing obligations for which it was granted an option to buy up to 5 billion XRP at 0.85 cents. Gossip suggested the settlement was anything from $100 million to $1 billion. However, given R3 still has a strong balance sheet despite a high burn rate and no recent funding, it became apparent the figure was significantly above $100 million.

Here’s the paragraph from the SEC filing: “in 2016, Ripple entered into an agreement with an enterprise software firm (“Option Investor B”) based in Manhattan that gave the firm an option to buy up to 5 billion XRP at a discounted price in exchange for efforts to help Ripple develop a “use” for XRP. The amount of XRP available for purchase under the option was later reduced, and Option Investor B purchased at least 1.04 billion XRP in 2019.”