Spain’s national payments operator Iberpay has announced the next stage of its Smart Money initiative. It plans to test the issuance, distribution and redemption of tokenized digital money with five banks. This isn’t a purely wholesale banking trial. End-customers and corporates will also be involved, so the scope is extensive. Banco Sabadell, Banco Santander, Bankia, BBVA and CaixaBank also participated in tests earlier this year for automated payments using smart contracts.

The proof of concept (PoC) is being run on Red-i, the test environment for Iberpay’s interbank blockchain network which connects to the Spanish Retail Payments System (SNCE).

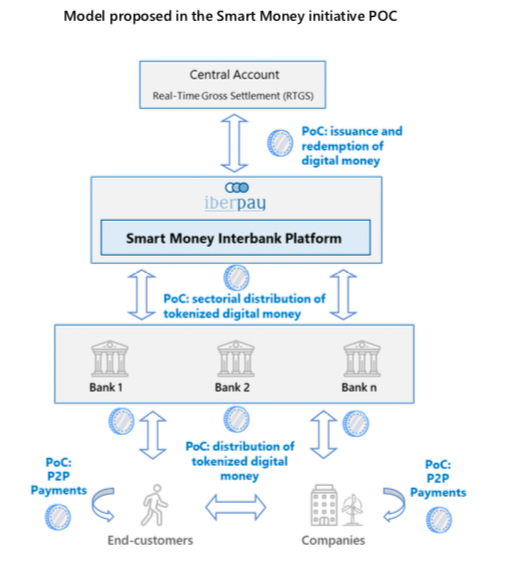

The trial envisions a future where there will be digital money solutions “backed by funds in central bank accounts.” While Iberpay did not use the term, that’s otherwise known as a synthetic CBDC or central bank digital currency.

There are several aspects to the tests. Firstly the issuance and distribution of tokenized money from the Smart Money Interbank Platform to banks. Secondly, the commercial banks will distribute tokenized money to their customers. Corporates will allow the money to be used by retail customers for payments. And customers will be able to use the tokenized cash for P2P payments.

Iberpay wants to see the impact on the financial sector of this sort of digital money distribution. It envisions programmable money as enabling new high-value digital services and it wants to prepare for that future.

The PoC will run from this month to Q2 2021, and additional banks might join.

While these tests involved synthetic digital Euros, yesterday, the European Central Bank President Christine Lagarde was upbeat about the prospects of a digital Euro central bank digital currency.