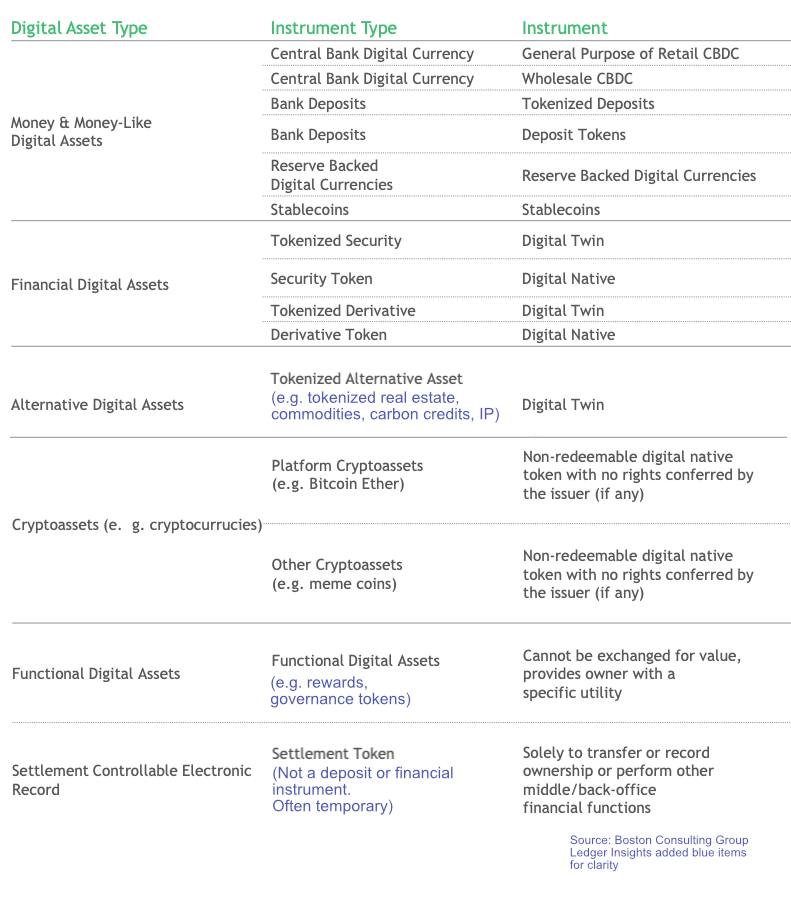

A new digital asset taxonomy has been proposed to the Commodity Futures Trading Commission (CFTC). The CFTC’s Global Markets Advisory Committee (GMAC) has a Digital Assets Subcommittee, which developed and voted in favor of the proposal on Wednesday.

CFTC Commissioner Pham noted the broad engagement of traditional finance (TradFi) and digitally native firms.

“I think that the quality of the output is tremendous, particularly given the socialization and the feedback not just from the members, many of which are global, but also I understand it from international organizations and regulatory counterparts around the world. So this is something that has definitely been very pressure tested,” said Commissioner Pham.

This taxonomy could guide future regulatory and policy decisions.

The proposal defines a digital asset in a technology agnostic manner, with the Subcommittee noting that the type of database or network should not be part of the classification. “Doing so is inconsistent with how financial instruments (and non-financial instruments) today are classified and could have unintended consequences for the application of market regulations.”

Digital Asset definition

A controllable electronic record, where one or more parties can exclusively exercise control through transfer of this record and where the controllable record itself is uniquely identifiable. Excluded from the definition of digital asset are those controllable electronic records that exist in and function solely as part of a financial institution’s books and records.

As with all taxonomies, not everybody will agree with every aspect. But much of this taxonomy makes a lot of sense. The Subcommittee acknowledged that this is not a static categorization because the sector is evolving. It especially expects the classification of functional digital assets, including governance tokens and rewards, to evolve.

Franklin Templeton is one of the TradFi institutions that have embraced blockchain and crypto. SVP Sandy Kaul highlighted the use case approach.

“Having the classification break them (digital assets) out, and then being able to match that with the use case is what is going to give us the ability to say, this is clearly something that is not any kind of financial asset. Or this is clearly something that is a financial asset. Or there is uncertainty here and more investigation needs to happen,” said Ms Kaul.

“If we try to treat everything that rides on blockchain rails and can be traded on unregulated exchanges as the same type of asset, we are doing a disservice in thinking about how they should be considered for potential regulation. Because they all are quite different when you think about them under the covers and how they are utilized.”

A strict stablecoin definition

One of the notable aspects of the categorization was the one relating to stablecoins. It has a strict definition, particularly for backing assets. Reserves must only include cash and high quality liquid assets (HQLA). If the reserves include higher risks assets, then it will be classified as an ‘other cryptoasset’.

We’d note that if the structure ensures the reserves are properly ring-fenced, perhaps an alternative classification is as a tokenized alternative asset. If the reserves include cryptoassets, classifying it as an ‘other cryptoasset’ makes sense.

Tether, the world’s largest stablecoin with a market capitalization of more than $100 billion, would not be classified as a stablecoin under the proposed CFTC taxonomy.

Slides and a longer explanation document are available for download.