The European Central Bank (ECB) has previously said it will set the holding limits for the digital euro based on the economic situation when the central bank digital currency (CBDC) is launched. It’s been working on a methodology for the calculation, which is a pretty complicated task, as we’ll come to. Holding limits are a contentious issue.

In the very early days of discussions about the digital euro, the central bank proposed a holding limit of around €3,000. If someone receives an amount pushing them over the limit, the digital euro wallet would sweep the excess amount into their bank account as a ‘waterfall’. If they want to spend more than €3,000 using the CBDC, the additional money comes from their bank in a reverse waterfall.

Holding limits are contentious

The topic is contentious at multiple levels. Late last year reports emerged that nine European states are not keen for the ECB to set the limits, including France and Germany. A big part of that is a concern that the ECB will set the limit too high and negatively impact the banking system. Income levels differ significantly between countries, so arguably one might want local limits, but that goes against the whole union angle.

Banks want to see a figure of closer to €500. The European Banking Federation commissioned a report that found with a 40% take up at the €3,000 level, it would reduce bank profits by €8.8 billion a year. At €500, with a 100% take up, this would cost banks €3.8 billion.

The digital euro legislation has not yet been passed. One of the proposed amendments last year was to leave it up to banks to set the limits.

WIP on the ECB methodology for holding limits

The ECB has been discussing its direction on a holding limit methodology with the Euro Retail Payments Board (ERPB). It emphasized the current state of the methodology is still a work in progress (WIP), but it involves three blocks of work:

- How does it impact the usability of the digital euro?

- How does it impact monetary policy?

- How does it impact financial stability through the impact on bank funding, balance sheets and profitability?

Here’s we’ll focus on the first one, as the other two involve technical modeling.

The central bank hasn’t yet clarified how the three blocks will come together. If usability says it should be €10,000, but that’s awful for financial stability, how does it decide? In all likelihood, the usability will dictate a figure that will be bad for banks.

Holding limits and usability

From a usability perspective, it doesn’t take a genius to figure out that removing holding limits would be optimal.

There are two aspects to the usability work – assessing how much people might want to spend, and figuring out their behavior. In terms of spending amounts, the central bank isn’t simply thinking about paying for coffee and the subway. It is including ALL spending, apart from rent, mortgage payments or loan repayments. Additionally, its exploring people receiving their entire income via the digital euro.

Regarding behavior, they want to assess whether users are likely to keep their money in the digital euro wallet (pre-fund), or use the reverse waterfall. For that they intend to run a survey in each country involving 1,000 or so people.

Apparently the survey plans to take 20 minutes, involve 21 questions and will include ‘stimuli’. By that do they mean coffee, a cattle prod, or perhaps subject matter prompts? Even with a positive intent and preparation, there’s a good chance those survey results could diverge significantly from reality.

For those keen to delve into the details regarding the monetary policy impact, there was a paper published late last year that goes into the detail.

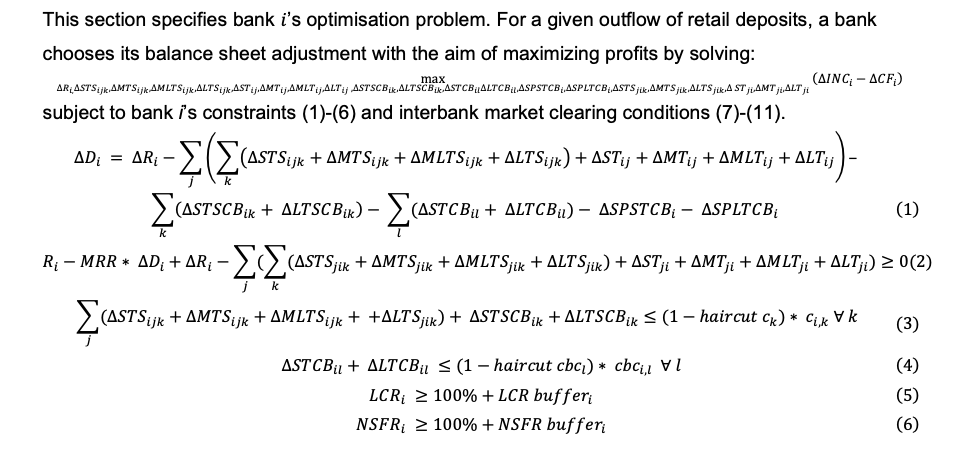

Regarding the impact on banks and hence financial stability, one of the models is below. At first glance, it looks a lot worse than it is!