Yesterday PayPal held its first investor day under new CEO Alex Chriss, where it briefly touched on its cryptocurrency activities. To date, the stablecoin has mainly been used within the crypto ecosystem, despite being available via the PayPal app and Venmo. PayPal intends to change that by rolling it out for B2B use cases. Currently the market capitalization is just over $700 million.

During the event, Mr Chriss outlined a desire to break down barriers between PayPal’s separate product offerings to create a more seamless solution for customers. The stablecoin can potentially play a role here.

As an example of breaking down those barriers, during this year it plans to encourage more of its 20 million merchants that use PayPal to accept payments, to also use its Bill Pay service to settle up with vendors. That’s according to Bloomberg which interviewed executives on the sidelines of the event. Where those vendors are cross border, PYUSD provides the option of paying without incurring foreign exchange fees.

Additionally, it acquired the Hyperwallet platform in 2018 that is used for mass payouts. It supports payments to contract workers, freelancers or merchants for platform businesses. Within the first half of this year it plans to enable payouts using PYUSD.

It’s notable that mass payouts was one of the early use cases implemented Bridge, the stablecoin infrastructure recently acquired by Stripe. Bridge landed US Aid as one of its earliest customers, helping it to make thousands of international payments.

Meanwhile, PayPal enabled PYUSD for cross border payments almost a year ago.

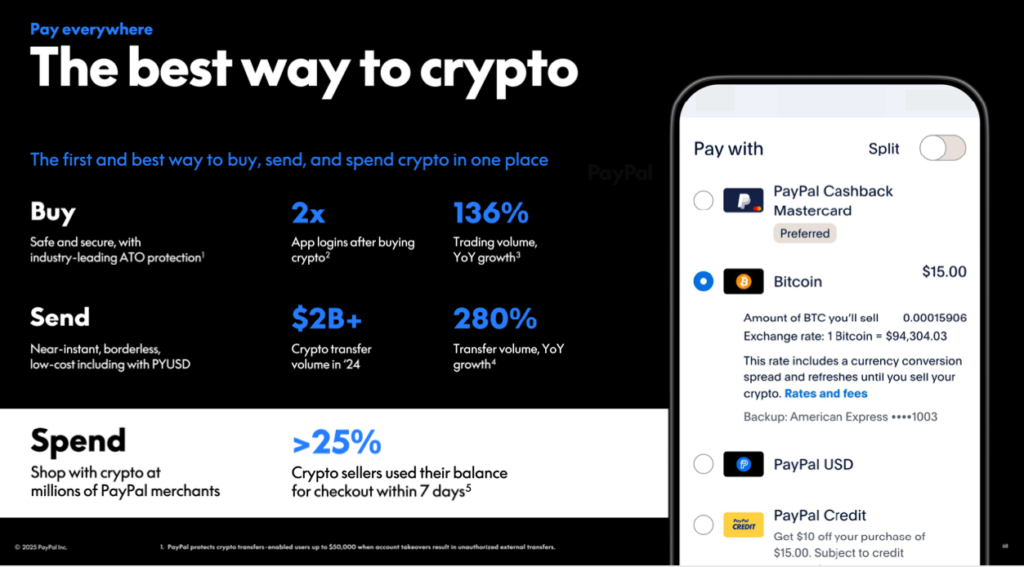

During yesterday’s event, the speakers also briefly touched on the company’s progress in cryptocurrency activities. PayPal was one of the first mainstream financial firms to support retail cryptocurrency holdings.