Today Northern Trust shared the results of a very recent London poll of 100 investment professionals, with 34% either already investing in digital assets or planning to soon.

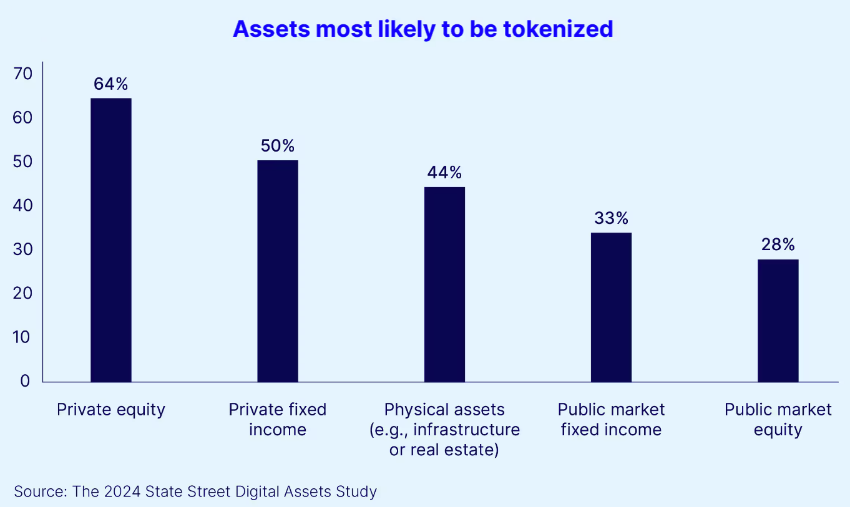

Which assets to tokenize?

Opinions differ on which assets are likely to be tokenized first. Northern Trust’s poll found that two thirds believe private assets will benefit most. The next most promising groups are commodities and real estate (53%) followed by money market funds (36%).

“These findings underscore the duality of opportunities and challenges as our clients navigate their data needs with the emerging integration of digital assets and advanced technologies,” said Pete Cherecwich, incoming COO at Northern Trust.

State Street digital asset survey

Meanwhile, in June State Street published a survey of 300 investment institutions across the globe. It warned that it conducted the survey shortly after the launch of Bitcoin ETFs in the U.S. which may have affected the responses.

The results regarding the assets most likely to be tokenized were very similar to the Northern Trust poll.

The State Street respondents had a high engagement in digital assets, with 62% already having a dedicated digital asset function, while all the rest (bar 5%) plan to create one. Generally, the group was pretty optimistic about the potential benefits of digital assets, ranging from better distribution to lower compliance and trading costs.

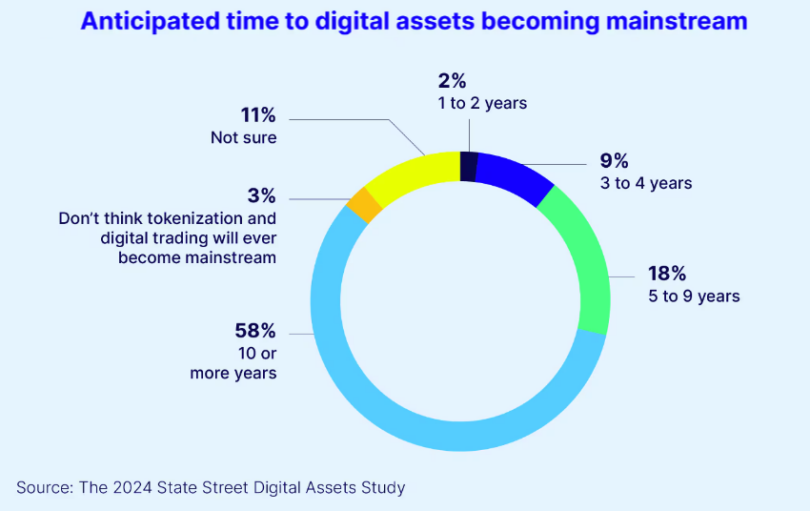

Despite that optimism, one of State Street’s most striking findings was the expected time for digital assets to go mainstream, particularly the interoperability between traditional finance (TradFi) and decentralized finance (DeFi). More than half (58%) believe it will take ten years or more to go mainstream with just 11% predicting it will take less than five years.

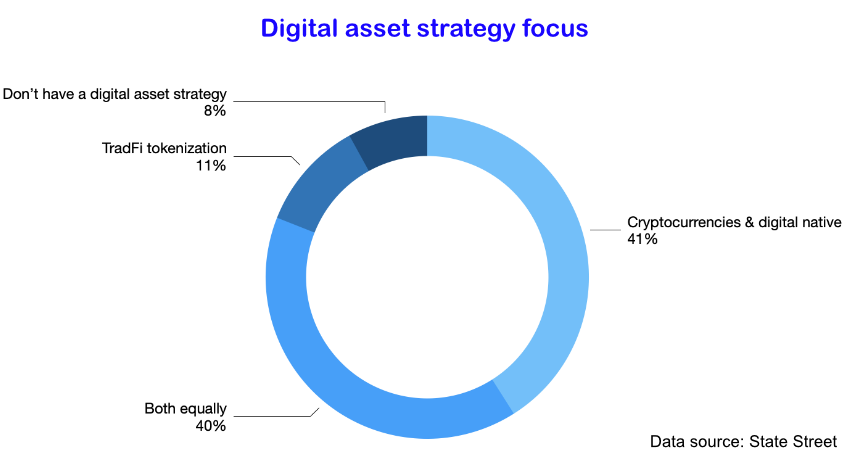

Forty percent of investors have an equal emphasis on tokenization and cryptocurrencies, whereas 41% are primarily focused on crypto. Americans are over represented in the ‘only crypto’ segment and have significantly more bullish expectations for crypto. Despite a perception that APAC has a huge appetite for crypto, twice the number of Americans (45%) expect higher returns from crypto than tokenized investments compared to APAC investors (22%). APAC investors were roughly three times more enthusiastic about central bank digital currencies (28%) compared to Americans and Europeans.