Non-fungible token (NFT) platform Mojito, a spinout of Web3 marketing firm Serotonin, announced a $20 million funding valuing the company at $100 million. Strategic investors include auction house Sotheby’s and Connect Ventures, a joint venture between sports and entertainment firm Creative Artists Agency (CAA), and global venture capital firm New Enterprise Associates (NEA). Future Perfect Ventures led the round.

The market for NFT marketplaces is becoming ever more crowded. One trend is established players in the blockchain and crypto industry such as FTX, Binance, and Coinbase launching their own NFTl markets. More niche initiatives are emerging, focusing on specific content such as sports, character-like avatars, cards of iconic personalities, luxury brand NFTs, and others.

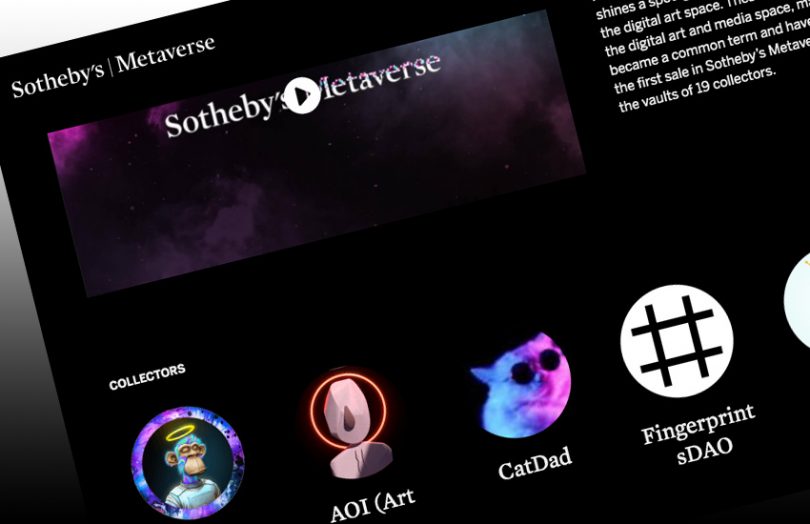

Mojito aims to surf that wave of specialist marketplaces by supplying the solution to operate them. For example, it partnered with Sotheby’s to launch a metaverse destination for NFTs, where Mojito operates the technology platform.

While Christie’s was the first auction house to sell an NFT and make headlines for the $69 million Beeple auction, Sotheby’s has been a fast follower in the digital space. It auctioned its first NFT soon after the Beeple sale and partnered with digital artist PAK to auction a full collection of NFTs. It has been exploring NFT technology to produce digital twins of art pieces and has now become the first auction house to launch a dedicated marketplace for digital assets.

Sotheby’s is a pretty strong brand to showcase Mojito’s platform. Now it wants to help others.

“Mojito is unlocking the ability for IP of any kind to be brought into the Metaverse, which is what we believe will be the next evolution of the internet,” said Mojito’s CEO Dan Kinsley. “We are thrilled to have the support of investors who recognize the momentous opportunity for artists, celebrities, athletes, and brands to engage their audience in meaningful new ways with our technology.”