The Information reported that OpenSea, the eBay-like NFT marketplace, has received investment approaches that value the company at $10 billion. The startup did not initiate the funding process.

In July, OpenSea raised a $100 million Series B at a reported $1.5 billion valuation led by Andreesen Horowitz. They also led its March $23 million Series A.

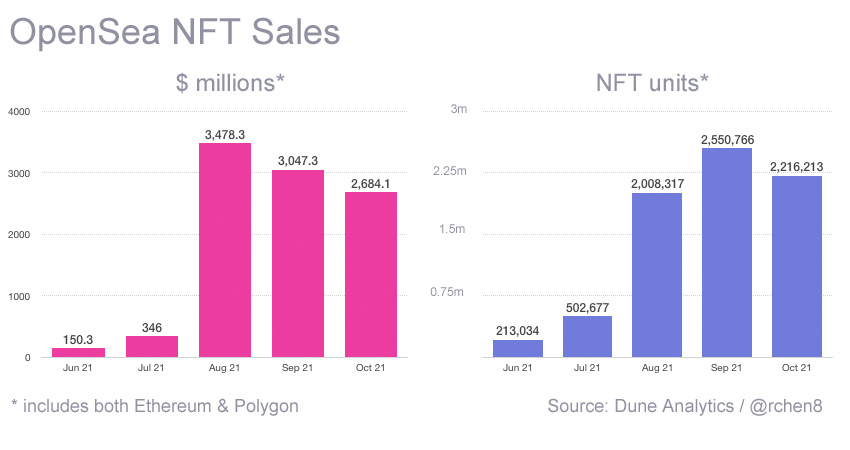

The company’s NFT sales went from $2.8 million in December 2020, peaking at $3.4 billion in August. In October, the figure was $2.6 billion. It takes 2.5% on all transactions.

OpenSea is not without competition, but to date, it has managed to stay well ahead of the pack. Dedicated NFT marketplaces include Rarible, SuperRare, MakersPlace and Mintable. However, in October, OpenSea did $2.7 billion in sales compared to SuperRare’s $37 million and Rarible’s $18 million.

The real challenge will come from the cryptocurrency exchanges. Both Binance and FTX have already launched NFT marketplaces and Coinbase launched a waiting list in October. However, FTX has focused on NFTs on the Solana blockchain, Binance has focused on its Binance Smart Chain and Ethereum. Opensea currently supports Ethereum and Ethereum Layer 2 Polygon.

During the last week, OpenSea sales have increased because of interest in the Bored Ape Yacht Club following the launch of two bands made up of Bored Ape characters. The labels launching the groups are a Universal Music subsidiary 10:22PM and Grammy award winning star Timbaland. The average price of a Bored Ape in the last week was $226,000, according to CryptoSlam. A rare one sold for $3.4 million at Sotheby’s last month.

[newsletter_form type=”minimal” placeholder=”Enter email for NFT newsletter” list=”11″]Applications relating to NFTs are attracting massive funding rounds. Last week Warner Music and Animoca backed blockchain games platform Forte in a $725 million Series B round. A week earlier, Mythical Games raised $150 million. And in September, sports collectible and fantasy game platform Sorare raised $680 million led by Softbank.