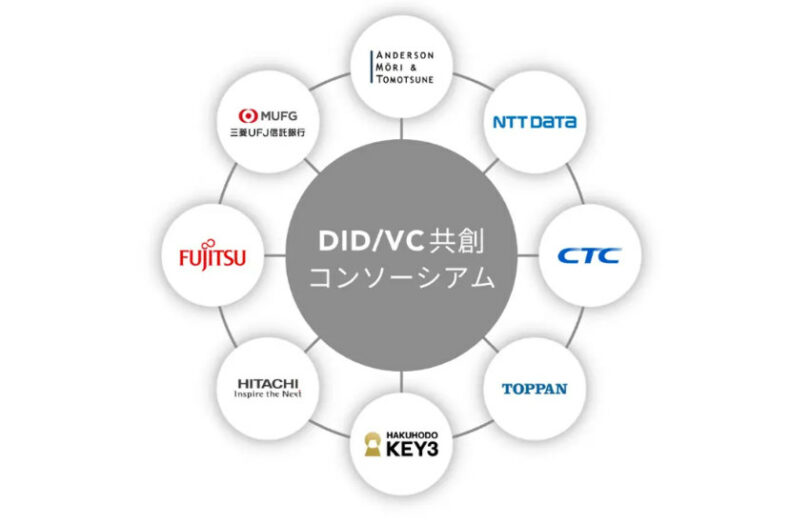

Eight Japanese firms announced the formation of a decentralized identity (DID) and verifiable credential (VC) co-creation consortium (DVCC). The group includes Japan’s largest bank MUFG, law firm Anderson Mori & Tomotsune and several of Japan’s largest technology firms. They include Fujitsu, Hitachi, NTT Data, TOPPAN Digital, ITOCHU Tecno and Hakuhodo Key3.

The consortium plans to jointly experiment with use cases as well as ensure interoperability between the solutions developed by participants. They may also share infrastructure. There was mention of self sovereign identity, which lets users keep control of their own information.

All the companies are involved in DLT solutions, but MUFG is the founder of the Progmat tokenization platform, where NTT Data is also a member. Identity is a key piece of the puzzle for both digital securities and digital cash. However, this was not mentioned in the announcement. Nor were any particular use cases disclosed. The participants invited other companies to join.

One particular area where identity is essential is for deposit backed stablecoins. Japanese stablecoin legislation came into force in June, allowing for three types of stablecoins. The two main ones are bank deposit stablecoins and trust managed stablecoins. To date, MUFG’s Progmat Coin platform has targeted trust managed stablecoins, where it claims no end user KYC is necessary. However, its notable that the MUFG Trust arm appears to be the coordinator of this identity initiative. KYC is definitely required for bank deposit stablecoins.

Another area where identity will be imporant is the metaverse. MUFG, Fujitsu and TOPPAN are also participants in another consortium, the Japan Metaverse Economic Zone (JMEZ).