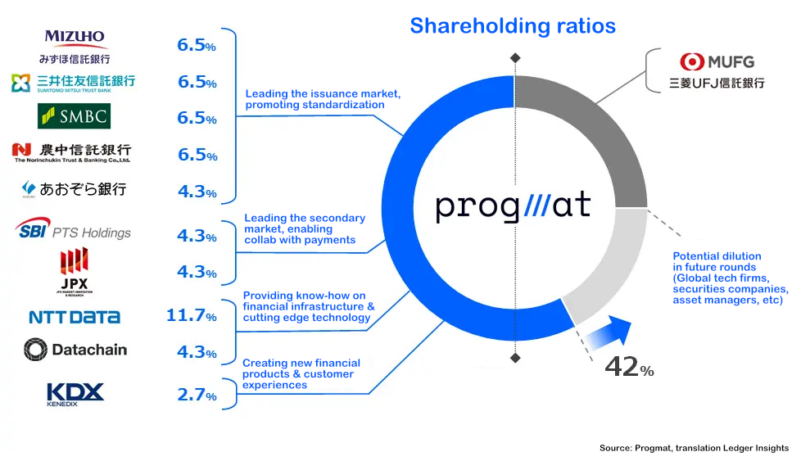

Earlier this week Japan’s Progmat digital securities platform announced a new funding round featuring three new investors. The platform was originally founded by Japan’s largest bank, MUFG, but with this latest funding the bank’s shareholding was diluted from 49% to 42%. The amount of the ‘pre Series A first closing’ was not disclosed.

The new investors are Nochun Trust and Banking, Aozora Bank and real estate firm Kenedix.

With the new funding round, other shareholders were diluted, including the three other banks, SMBC, Mizuho and Sumitomo Mitsui Trust, which each previously held 7.5% and now own just under 6.5%.

Progmat is already the largest Japanese digital securities issuance platform, with its primary competitor being the ‘iBet for Fin’ platform, which is part of Nomura-founded BOOSTRY. The two platforms share some common investors, such as JPX, the owner of the Tokyo stock exchange. But make no mistake, Progmat has ambitions beyond Japan.

“We will work hard with our members to expand our founding philosophy of ‘national infrastructure’ not only domestically but also to the world,” said Progmat CEO and founder Tatsuya Saito. “In order to aim for a great product on a global scale, we will create a great team.”

Expanding the types of digital securities and tokens

While digital securities in Europe have been dominated by bonds and funds, in Japan it has primarily been real estate tokenization, with less than a handful of bond issuances.

Each of the new investors could potentially expand the range of tokenized assets on the Progmat platform. For example, Norinchukin Trust Bank (Nochun) is owned by Norinchukin Bank, Japan’s largest institutional investor. Nochun is looking to use tokenization to expand the market for certain assets that were previously only available to institutional investors. It’s also eyeing the tokenization of commodities from the agriculture, forestry and fishery sectors in which it specializes.

Aozora has quite a bit of experience in bond issuance as well as LBO finance and real estate, amongst other areas.

Kenedix is one of Japan’s largest real estate asset managers and has already been involved in several tokenized real estate issuances. While it started by using the Progmat platform, it has also used BOOSTRY’s offering as well. Now it is planning to launch a mobile app dedicated to security tokens, with the intention of also offering its investors utility tokens and stablecoins, both areas within Progmat’s remit.

“We believe that Progmat’s effort to develop ‘national infrastructure’ not only domestically but also globally, will contribute greatly to the development of the digital asset market,” said Jun Shinozaki of Aozora Bank.

Progmat leans into stablecoins

We’ve previously reported that Progmat Coin acts as a stablecoin issuance platform with the reserves held by one of the associated trust banks. In the funding announcement, it spoke about the potential for stablecoins in cross border payments. In September 2024 it announced that the big three Japanese banks are working on this together.

It noted that not only can stablecoins provide certainty around the timing of the payment arriving, but they can use smart contracts for automation. Plus, stablecoins are particularly appropriate for the settlement of digital securities.

How to build a bank-founded startup

Meanwhile, alongside the funding announcement, Progmat CEO, Tatsuya Saito, shared some of the thinking behind the founding of Progmat in a blog post (in Japanese). He particularly explained how to found an innovative startup within a bank.

When he initially floated the idea within MUFG, rather than promoting it as a new revenue opportunity, he suggested it as a survival strategy. After all, the essential role of a trust bank is to manage a ledger, which is automated using blockchain.

This foundation explains the current shareholders, with five banks that are mainly trust banks. He also was keen to separate Progmat from MUFG, deliberately choosing the vivid blue color, which contrasts with MUFG’s red. Venture capital firms were not courted as investors, given Progmat was always likely to take time to reach scale and the motivations behind it.

Mr Saito stated that the current shareholding is neutral, with no securities firms investing so far. SBI is represented by SBI PTS, the company that owns the Osaka Digital Exchange (ODX), rather than SBI Securities. However, the diagram about the shareholdings shows plans to include securities firms in the future.

While his blog post is not a short read, it may be useful for anyone trying to push innovation from within a bank. So far his strategies with Progmat appear to be successful.