Today MUFG announced it used digitized documents on the komgo blockchain trade finance network. Because the documents supporting the letter of credit are authenticated and timestamped with an audit trail, it helps to mitigate fraud. The transaction was an oil trade between Mercuria Energy Trading and Gunvor with all three firms investors in komgo.

Komgo investors are: ABN AMRO, BNP Paribas, Citi, Crédit Agricole Group, Gunvor, ING, Koch Supply & Trading, Macquarie, Mercuria, MUFG Bank, Natixis, Rabobank, Shell, SGS and Société Générale.

MUFG is also a member of the Marco Polo trade finance network and it’s participating in the Singapore TradeTrust blockchain interoperability framework.

MUFG announcement:

Note: we are experimenting with some articles, publishing the announcement, sometimes prefixed with a brief commentary in order to focus on more exclusive content.

MUFG has completed its first complete transaction using Trakk, a unique blockchain system that builds document audit trails to guard against fraud and falsification.

Trakk, a tool developed by Komgo, allows users to stamp, trace, and authenticate digital documents. It ensures that any action that is registered on a document is linked to both the company and the individual authorised to perform the action, building a unique and immutable audit trail behind digital documents.

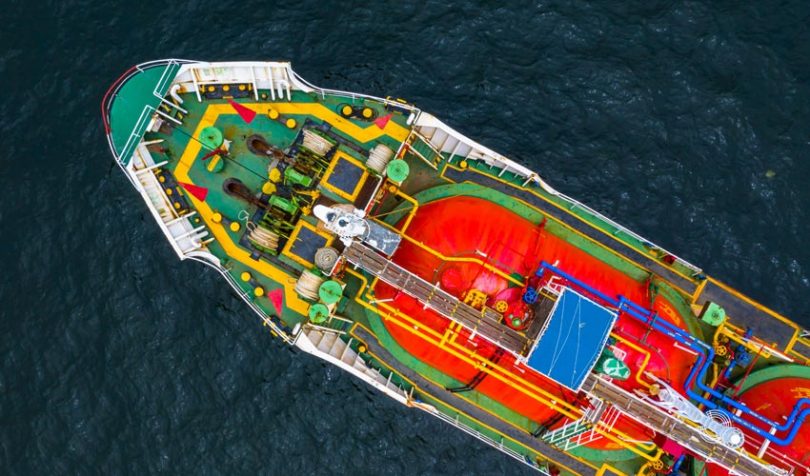

MUFG used this innovative technology to facilitate a transaction whereby Mercuria Energy Trading, a commodity trading company, purchased crude oil from Gunvor Group. The transaction included a sales contract, letters of credit, and purchase documents housed and authenticated in the Trakk blockchain system.

Jean-Marie Le Fouest, Head of Commodity and Structured Trade Finance for MUFG EMEA, said: “The US$4 trillion physical commodities trading market is almost entirely transacted using paper and email, and it is more important than ever to continue innovating processes within the commodity trade finance industry and push the sector forward by taking advantage of new technologies.

“It was a great privilege to support our clients Mercuria and Gunvor on this transaction, which demonstrated the numerous practical advantages of using Trakk on the Komgo platform.”

Geneva-based KomGo SA was formed in 2018 by MUFG and 14 other global institutions, including banks, commodities traders, energy majors, and a certification company.

The Komgo platform also offers trade finance products such as letters of credit, standby letters of credit, and receivables discounting. Additionally, it has a Know Your Customer (KYC) compliance solution, which standardises the KYC process without using a central database.

MUFG’s first letter of credit was executed in London on Komgo’s platform for Mercuria Energy Trading in December 2019. This transaction builds on initiatives from MUFG to spearhead digitalisation within commodities trading and commodity trade finance operations, with the aim of increasing security and transparency for its clients globally.