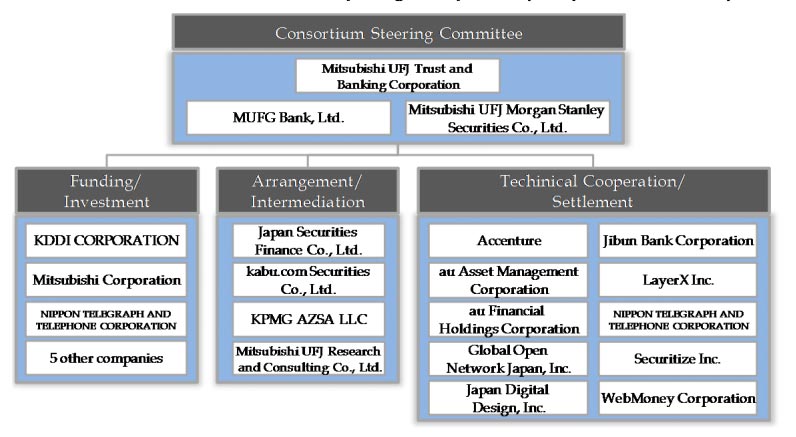

Today MUFG announced a research consortium to explore the use of blockchain and security tokens for automatic securities settlement. Dubbed the ST Research Consortium, in addition to MUFG group companies, the membership includes Mitsubishi, NTT, Accenture, KPMG and startup Securitize.

The objective is to enable both fundraising and management on the same platform and to use digital cash for settlement. The assets involved will include bonds and securitized products, but the initial emphasis appears to be on bonds.

Bonds are also the focus of the joint venture between competitor Nomura and related company Nomura Research which was launched two months ago. Both MUFG and Nomura invested in compliance token platform Securitize, which is a participant in the MUFG consortium.

The ST Research Consortium is targeting 24/7 trading without any special terminals and available to retail and overseas investors as well as domestically.

Programmable money was mentioned in the announcement, because of its ability to enable instant settlement. Immediate payment or delivery versus payment helps to reduce counterparty risk. Hence the legal title of the underlying assets can be transferred and updated at the same time.

MUFG is one of the investors in Fnality, which runs the Utility Settlement Coin (USC) initiative. The USC project involves coins backed by central bank money to enable delivery versus payment. However, it is targeted at institutions and will not be available for retail use.

But MUFG has been working for several years on its own retail payments initiative, MUFG Coin. Additionally, earlier this year it formed a payments joint venture with technology company Akamai called GO-NET.

MUFG said it had already executed proofs of concepts between July and October for the solution called Progmat. That included assessing blockchain technologies, and prototyping workflows and smart contracts for bond procedures. These include issuance, settlement, rights transfers, interest payments and redemption.

Other MUFG blockchain initiatives include its investment in R3, membership of the komgo commodities trade finance network and the use of Ripple for Brazilian payments.

Bonds have been a popular area for blockchain experiments amongst banks. Santander and Societe Generale both recently issued bonds on the public Ethereum blockchain. The World Bank has issued multiple tranches of its bond-i on a private blockchain. The Thailand Bond Market Association has plans to adopt the technology. And BBVA has run pilots for every imaginable type of loan.