MotorDAO aims to give fans a say in motorsport and provide a template for blockchain-enabled fan governance in the entire sports sector. Like many blockchain initiatives, MotoDAO plans to launch non-fungible tokens (NFTs). However, in addition to receiving a helmet NFT and racing perks, fans will get a voice in how to use the NFT money.

Highlights:

- Fans buy NFTs to become club members

- 85% of NFT proceeds go to motorsport teams or drivers (commercial rights)

- If enough NFTs are sold, fans potentially select a team driver, crew chief

- If less money is raised, funds go to young drivers

- Phoenicia curates the shortlist for voting

- How are DAOs different from fan tokens?

The funds could be used to back young drivers or for a racing team, possibly a new NASCAR truck team. Last week, the project was unveiled by sports company Phoenicia and Kubelt, the web3 content company.

From a business perspective, it’s worth asking what problem this solves? For a team or young driver, this could be an important source of funding. From the fan’s viewpoint, it democratizes sport, provided it’s done right.

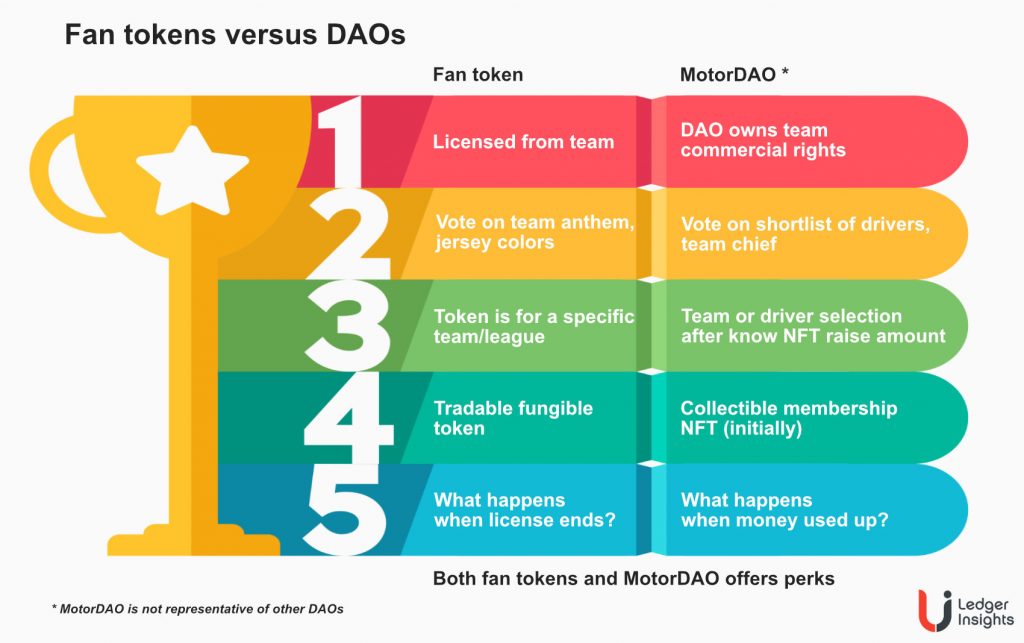

One challenge we predict is that sportspeople will think DAOs and fan tokens are very similar because they both aim at fan engagement. That might create a perception hurdle, and we explore the difference.

What’s a DAO?

DAOs or decentralized autonomous organizations are rarely decentralized or autonomous. They’re a mix of a cooperative, crowdfunding and blockchain technology. And every DAO is different.

It’s essentially a new kind of organizational structure somewhat similar to cooperatives. They’re sometimes described as group chat with a bank account. That’s because the objective is to create a pool of money to be used for a purpose. And that purpose is decided by stakeholders. In sports, fans are often the stakeholders that are consulted the least. DAOs can change that.

DAOs can provide a far greater level of engagement by ceding a certain level of control to fans without handing over day-to-day management. They can address a key desire of many sports fans: to have a say in team selection.

Membership not ownership

Depending on how a DAO is structured, the fan governance can be entirely separated from team ownership. In MotorDAO’s case, the initial NFTs provide a membership experience, but it’s not a fan token.

There’s a bit of a chicken and egg situation with MotorDAO. The amount of money raised by the DAO will influence which decisions fans can make. For example, if less than a million dollars is raised, that’s only enough money to back a young driver and the NFT holders will get to select which driver to back.

If the DAO raises $4 million, that’s enough to fund a NASCAR truck team. Six million could mean a NASCAR Xfinity team and $20 million could buy a place in the NASCAR Cup. In that case, fans potentially get to choose the car number and have a say in selecting the drivers and crew chief.

It’s curated: fans have a say up to a point

A key feature of MotorDAO is that it’s heavily curated by Phoenicia. The company’s CEO, Chris Lencheski, has extensive sports finance experience including as a NASCAR team owner. While fans get to nominate which potential drivers to back, when it comes to the final vote there will be a shortlist of three selected by Phoenicia.

The rationale is to add a layer of professionalism to ensure that any drivers who receive funding have some experience and credentials. But make no mistake, Lencheski and Phoenicia will have a big say because it gets to choose the shortlist. Effectively 85% of funds raised go to Phoenicia to invest in drivers or teams.

Currently, the DAO is keen to engage with potential fan members on Discord to find out what people want. If it’s entirely up to Lencheski, then with sufficient funds the money is likely to be used for some sort of NASCAR team. But Formula 1 drivers, indyCar, motoGP and others motorsports will be considered.

DAOs v fan tokens

Unlike NFTs, which are viewed as collectibles, fan tokens are generally classed as cryptocurrencies. Fan tokens have received quite a bit of pushback from fan associations in Europe and the UK’s Advertising Standards Association, who worry about uninformed fans losing money. And they’re banned by the NFL. So a key hurdle for DAOs in sport is to differentiate them from fan tokens. In some cases, they could end up being similar.

For sport, what DAOs and fan tokens have in common is they’re both about fan engagement. Fan token holders get perks like discounted tickets, merchandise and the ability to participate in inconsequential decisions such as selecting a team anthem or jersey colors. So far, pretty much all fan tokens have involved a company buying a license from a team or league to issue the token. Hence the token issuer is one step removed from the team. Socios, Bitci and Binance have issued most fan tokens.

We’ve already seen the problem of that separation when McLaren dropped Bitci, a sponsor with whom it had a fan token arrangement. Other teams sponsored by Bitci alleged that it didn’t pay. But the fans DID pay for their tokens, and where does that leave them? The answer is out of pocket.

According to Lencheski, the difference between a fan token and DAOs such as MotorDAO is the fans have a more direct membership from the team, and therefore, the engagement is more direct. But that really depends on the relationship. We understand that MotorDAO would buy the team’s or driver’s commercial rights. So there is still some separation.

MotorDAO risks

But there’s also a disadvantage to the MotorDAO approach. Socios is selling fan tokens in clubs that have established fan bases. When people buy MotorDAO’s NFT tokens, they don’t know what they’ll get beyond the NFT. Until the funds are raised, MotorDAO can’t say whether the funds will go to drivers or teams, and any team will likely be a new one.

Mystery often appeals to NFT holders, but usually when it’s associated with an established brand. So MotorDAO is tapping into the broader ‘motorsport’ fan rather than a fan of a particular team or brand like Hendrick Motorsport, Team Penske, or McClaren. That’s a tougher sell. But that’s also the point because the NFT members get to decide.

It’s not just a matter of attracting fans. It’s also the perception of risk. If a team itself created a DAO, then you’re handing money over to something associated with an established brand with the perception of low risk.

While MotorDAO and its founding participants appear credible (do your own due diligence), it’s not the same as buying into a concept from an established brand. And based on crypto history, it’s likely that some scammer will try to copy MotorDAOs model in the future particularly because responsibility for 85% of the funds gets handed over to Phoenicia.

Will sports teams cede control?

We were curious about whether teams would be willing to give up the control involved in a DAO. Lencheski said there has to be an economic incentive for a team. So if it can easily raise backing or sponsorship without ceding any control, it’s more likely to do that. Hence in motorsport, it might appeal more to backmarker teams. And he predicts it could be five to seven years before this sort of structure becomes more commonplace.

If the trajectory of NFTs is anything to go by, it could be faster. But it significantly depends on the structure and the degree of fan engagement. There’s a potential economic benefit beyond the direct funds raised via a DAO. Sports sponsorship aims to gain profile and exposure, so greater fan engagement is valuable in itself.

How MotorDAO is structured

Some DAOs are quite literally chat groups with crypto wallets. This one is underpinned by a Delaware C Corporation. Phoenicia is contracted to use 85% of the proceeds raised to invest in commercial rights in drivers or teams. Lencheski is keen to target fans rather than big pockets.

“What I don’t want to be is in a position where someone says, well, I nominate this person (driver) and therefore they should go, and I own the most tokens,” said Lencheski. “We’ve been really clear that Phoenicia will be responsible for producing the opportunities and the DAO will have abilities to vote.”

The votes are structured so that one or two whale NFT holders won’t be able to dictate. Some members – such as Phoenicia and Kubelt – will have bigger votes. That’s not dissimilar to the way Mark Zuckerberg has supervoting stock at Meta. But it also means it’s not decentralized.

Don’t expect any returns

Another question is, what happens to returns? Many lower ranked teams don’t make money. MotorDAO is buying out the commercial rights of the driver or the team and then trying to make money from that. In the case of the driver, it’s about selling space on the helmet, or if they’re more of an unknown, potentially taking a cut of future earnings.

Lencheski spoke about a scenario where $4 million is raised from NFTs and committed to a team. “Let’s say we make $500,000 between sponsorship, licensing, merchandising and commercial rights,” said Lencheski. “That’s $500,000 right now has to come back to the DAO treasury. That’s how we’ve set this.”

And, of course, the DAO gets to vote on how that money is re-used. But it’s worth highlighting that hypothetical $4m went in, and that money is gone, bar the hypothetical $500,000 return. So how long will this last?

One of the biggest players in blockchain games, Animoca, had to pull its F1 Delta Time game when its license expired. And that game included some extremely valuable NFTs. So one big question about MotorDAO’s NFTs is what happens after the first year? Say it spends $4m and gets back $500,000. A team that gets that $4m is only going to commit to fan perks such as in-person events for the commercial rights period.

MotorDAO’s partners and roadmap

There’s a related area not mentioned by Lencheski: the potential for a future fungible token beyond NFTs. And we’ll engage in some speculation here based on one of MotorDAO’s partners.

Apart from the two founders, Phoenicia and Kubelt, several other organizations are involved in MotorDAO:

- Crypto fund Mentha Partners

- Near blockchain (in Mentha portfolio)

- KlimaDAO for carbon offsets

- SuperDAO: developing a set of DAO tools & frameworks.

SuperDAO has a DAO playbook which may or may not apply to MotorDAO. Issuing NFTs with governance and other benefits is just the early stage of the playbook. Afterward, there’s a more general token. There’s some precedence in this with the likes of the Bored Ape Yacht Club that released hugely popular NFTs and now an associated foundation has just released the APE token.

According to SuperDAO’s playbook, after a successful NFT issuance, the corporation behind the DAO talks to venture capital firms that buy equity, including a promise of future tokens (token warrants). This is speculation based on SuperDAO’s playbook, not what MotorDAO said.

We might be getting ahead of ourselves here. First, MotorDAO needs to develop a community and release some NFTs. Its Discord feedback group has 138 members a week after articles in two high profile sports publications. But the crypto crowd has not yet been targeted.

As with many other blockchain areas, the concept of sports DAOs is likely to evolve. MotorDAO is one of the first and presents just one potential structure. Whether or not MotorDAOs offering resonates remains to be seen. However, at a conceptual level, the way DAOs can potentially address both the funding needs of a team and fan democracy is compelling. If done right without appearing too scammy – and that’s a big ‘if’ – this could be yet another blockchain windfall to the sports sector.