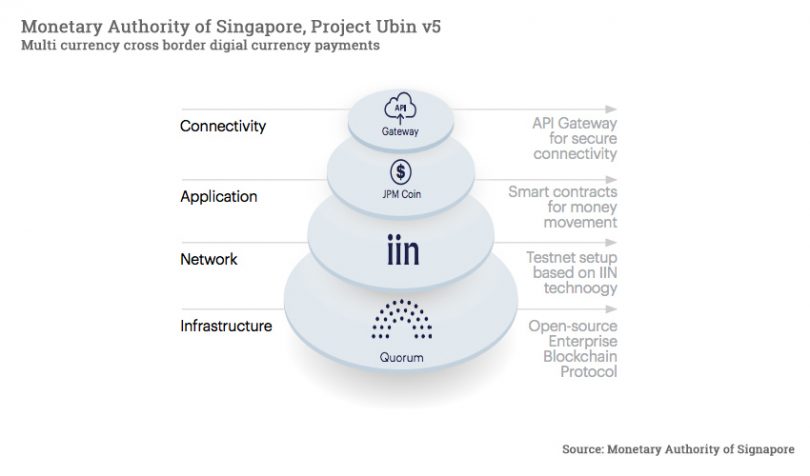

The Monetary Authority of Singapore said its multi-currency payment network prototype is a success, and it looks forward to seeing similar systems in action. The prototype was phase five of Project Ubin, a series of experiments that started by focusing on central bank digital currencies (CBDC). This final phase enabled multiple fiat currencies to exist on the same payments network, issued by either central banks or commercial banks.

The goal was to demonstrate the possibility of faster and cheaper transactions, including for cross border payments. The transaction savings are not just for the payment itself, because in many cases, such a system reduces the cost of the business transaction to which the payment relates.

For example, many business transactions require intermediaries or central counterparties to bear the risk of non-payment. By enabling immediate settlement – delivery versus payment – that risk disappears and hence the cost of intermediation is removed.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.