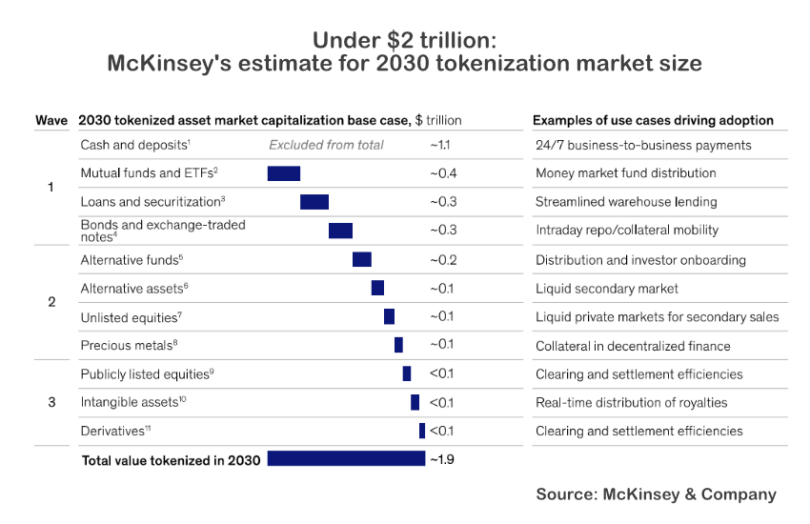

Two years ago Boston Consulting Group (BCG) estimated that the market size for tokenized assets would reach $16 trillion by 2030. However, the market has failed to reach the growth rate predicted for 2024. Yesterday, McKinsey & Co published its predictions that it would be less than $2 trillion by 2030, with a range of $1 to $4 trillion. This compares with estimates last year from Bernstein of $5 trillion by 2028 and the same figure from Citi by 2030.

Unlike BCG, McKinsey refrained from making annual predictions, a strategy that may mean we forget their projections by the time 2030 comes around. However, the consultants did share the reasoning behind their numbers. They pointed out that in the first five years of inception, financial innovations such as credit cards and ETFs showed annual growth rates of around 100%. Subsequently, growth slowed to 50% before declining further. Hence, McKinsey used a compound annual growth rate of 75 percent.

McKinsey’s paper acknowledges the progress in certain asset classes such as money market funds, loans and securitization, bonds and repos. Hence it sees these as part of the first wave of tokenization which is likely to reach significant size.

Tokenization and repos take the lead

It views only repos as having achieved what it terms the minimum viable value chain (MVVC). Rather than a minimum viable product, the nature of multi party blockchain transactions means there’s a need for a value chain that ideally should be on the same ledger or interoperable blockchains.

So far there are two in-production DLT repo solutions from Broadridge and JP Morgan. Earlier this week, we reported that Fnality and HQLAᵡ are looking to support a similar service in Europe later this year, subject to regulatory approvals.

McKinsey is right that repo is more mature. If you look at the Broadridge and JP Morgan platforms, they are more centralized. Participants use the Broadridge DLR solution, and in JP Morgan’s case, they are JPM clients. In contrast, the coming Fnality – HQLAᵡ interoperability plans to start with Deutsche Börse’s Eurex Repo F7 system, but it could support the backend for various other trading venues in the future.

Tokenized assets versus tokenized transactions

Notably, all market size calculations look at a static measure of assets tokenized. However, if instead one looks at transaction volumes, there’s quite a bit more activity. By early last year Broadridge had reached $1 trillion per month in repo trades, meaning there have been more than $17 trillion in trades since then. With repos, the underlying collateral such as Treasuries is not natively digital, so it is tokenized for the purpose of repo transactions. Once the repo is unwound the collateral is no longer tokenized.

Given that a significant aspect of blockchain benefits are in the post trade aspect, we believe there’s a strong argument for looking at transactions as well. However, these are still a tiny fraction of the repo market size.

There’s also the flipside argument. In order to address the so-called ‘cold start’ issue, there’s a need for integration with legacy systems. In some cases the natively digital assets are being accessed in a legacy manner, which could exaggerate their success. For example, the SIX Digital Exchange (SDX) has hosted six bond issuances in the last six months, including from the World Bank. However, one might argue that the appetite may have been more limited had the SDX CSD not been integrated with the main SIX SIS CSD, allowing mainstream investors to buy the bonds.