Today SuperRare, the nonfungible token (NFT) art marketplace, announced its $9 million Series A led by Velvet Sea Ventures and 1confirmation. Artists release limited edition artwork on the platform, which can be verified using blockchain and the NFT can be resold, with the artist receiving a 10% cut of any re-sale.

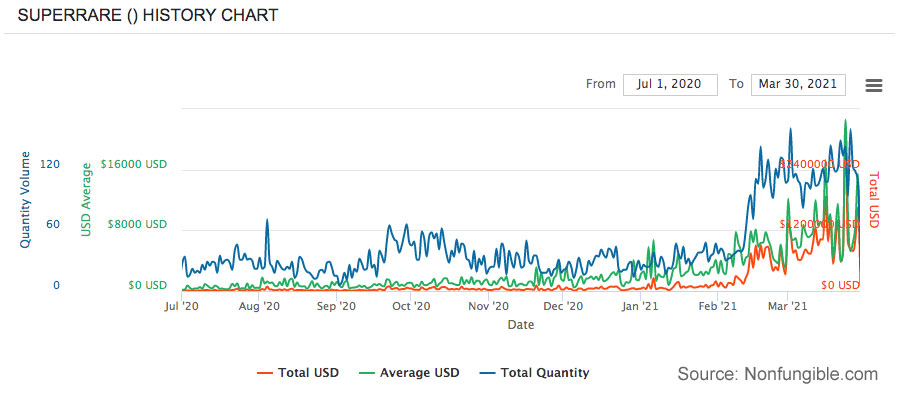

Launched in April 2018, like many NFT marketplaces, SuperRare volumes have taken off this year. According to a blog post, in the first year, sales averaged $8,000 a month. Current volumes are more like $25 million a month, including re-sales. To date, artists have earned more than $30 million.

As you can see from the graph below, there was a modest increase in the latter half of 2020, particularly in the average value of an item. Most artworks in July 2020 sold for in the low hundreds of dollars. By comparison, on March 24, 143 items sold for an average of more than $22,000 each.

SuperRare also hosted the high profile sales by Time magazine of three NFT covers. However, it has competition, with the closest one being MakersPlace, the destination used for many of Beeple’s sales, including providing the platform for the Christie’s $69 million NFT Beeple auction.

Other notable recent raises for NFT platforms were $23 million for OpenSea, which is trying to be the eBay of NFT’s aggregating other marketplaces. A $1.75 million seed round for Rarible. And today Dapper Labs raised $305 million. But Dapper is a little different as the operator of the hugely successful NBA TopShot and it also founded the Flow blockchain.

The SuperRare Series A was led by Velvet Sea Ventures and 1confirmation with participation from Version1, Collaborative Fund, Shrug Capital, Third Kind, The LAO, SamsungNext, Ashton Kutcher and Guy Oseary’s Sound Ventures, Andrew Stienwold, Mark Cuban, Marc Benioff, Naval Ravikant, and Chamath Palihapitiya.