Today, the Bank of Lithuania announced its blockchain-based digital collector’s coin (LBCoin) entered the final testing phase and would be issued in July.

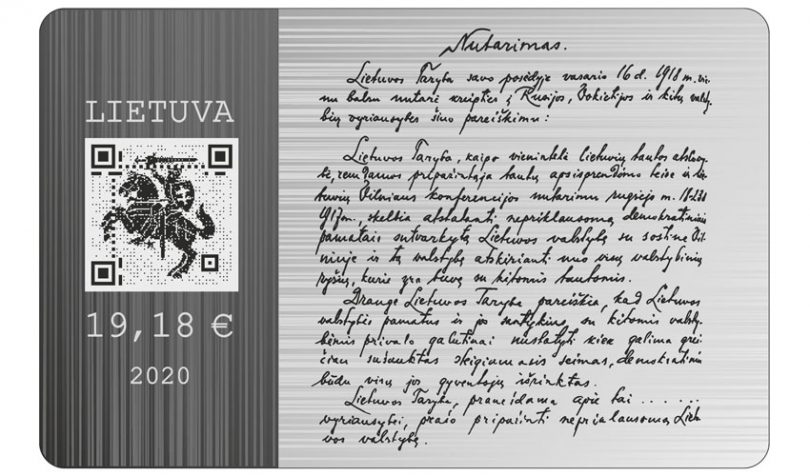

Late last year, the central bank announced plans for the LBCoin in celebration of the anniversary of Lithuania’s independence on February 16, 1918. The digital coin features the Act of Independence and its 20 signatories.

Concerning the development of the digital collector’s item, the central bank has completed user testing of the online shop where LBCoin will be sold. Additionally, it covered third-party services such as Know Your Customer (KYC) and payment collection.

“LBCOIN is based on innovative and sophisticated solutions. Therefore, it has to be tested at various angles, for example, in terms of functionality, personal data protection and resilience to cyber risks,” said Pavel Lipnevič, manager of the LBCOIN project at the Bank of Lithuania.

“During this final phase, the Bank of Lithuania has certainly gained some extremely valuable experience and insights.”

The initiative was launched in part to develop blockchain skills within the bank, including exploring digital currencies. Last year, the central bank published a paper reviewing central bank digital currency (CBDC) initiatives across the world.

The central bank will issue 24,000 LBCoins, which will be available through an e-shop. The 20 signatories will be divided into six categories depending on their occupation, with 4,000 tokens allotted to each group. A collector who manages to get all six digital tokens will then be able to exchange them for a silver collector coin which is not available for sale. Only 4,000 physical silver coins will be minted.

The digital coin is underpinned by NEM blockchain, which is currently in use for cryptocurrency transactions. Users can store, gift, and exchange the collector’s item through a public NEM wallet.

The Bank of Lithuania also operates a blockchain sandbox, and IBM Poland and Tieto Lithuania are developing LBChain for the central bank. The two companies worked separately on the project producing solutions for Hyperledger Fabric and Corda.

Earlier this week, Ledger Insights reported that IT consultancy BearingPoint used LBChain to develop a blockchain prototype for regulatory reporting of transactions.