Highlights:

- India is Facebook and WhatsApp’s largest market, but revenues low

- Facebook had pushback over WhatsApp Pay, now partly lifted

- Libra pushing for ecommerce, Jio launching ecommerce platform

- India’s Aadhaar identity enables eKYC

- Indians receptive to tech backed digital currency

On Tuesday, it was announced that Facebook invested $5.7 billion to take a 9.9% stake in Indian mobile operator Reliance Jio. The company was a wholly-owned subsidiary of Reliance Industries, India’s largest company according to Fortune India. Both parties stated that the tie up was about helping small businesses with digital. This is also an aim of Facebook’s Libra payments and digital currency initiative.

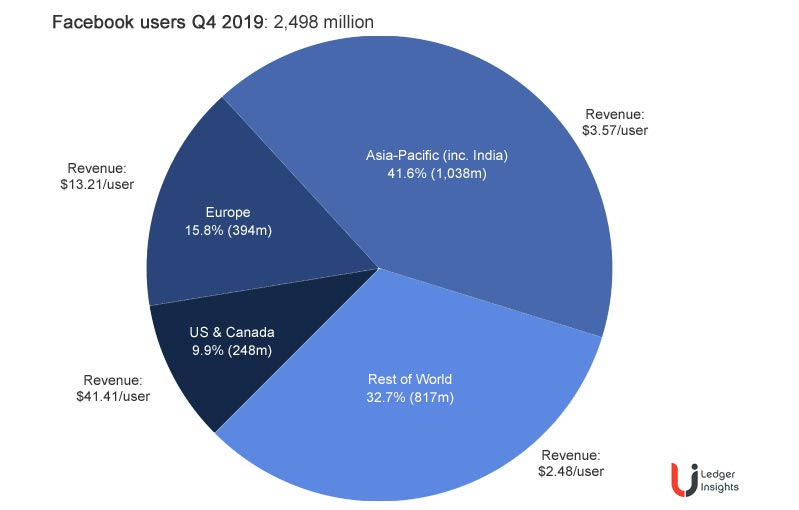

India is already the largest market for both Facebook (260 million users) and Facebook-owned WhatsApp (400 million users). But it lags significantly in terms of revenues. The revenue per user in North America at $41.41 is 11.6 times the average user revenue in the Asia-Pacific, including India. So the Jio deal is about commercialization as opposed to user acquisition.

“India has more than 60 million small businesses and millions of people rely on them for jobs,” said Zuckerberg in a statement. “We’re partnering with Jio to help people and businesses in India create new opportunities.”

Reliance Industries said part of the deal is an agreement with ecommerce platform JioMart and WhatsApp and to support small businesses on WhatsApp. JioMart is an online grocery portal in the process of launching, which is somewhat timely given the COVID-19 crisis.

Meanwhile, WhatsApp Pay is a solution unrelated to Libra and the Facebook Calibra Wallet, and WhatsApp Pay is also about to roll out in India. It leverages India’s UPI bank-to-bank instant payment system, as does Google Pay.

In 2018 WhatsApp Pay ran a one million user beta test in India but was blocked from launching by the National Payments Corporation of India (NPCI). That changed this February when it was given the go ahead for a phased roll out of up to ten million users.

According to the Business Standard, the difference between WhatsApp and the other wallet providers is the others had to build a user base, with the exception of Paytm. So the ten million user cap will ensure an orderly scale up for banks.

And going forward, having Reliance Industries’ Mukesh Ambani on Facebook’s side could be an advantage with the regulators to help raise the user limit.

Market potential – a billion payments a day – but there’s competition

What’s at stake in India is the potential to become the Indian equivalent of China’s Alipay or WeChat Pay. Both India and China have populations of 1.4 billion.

Tencent, the parent of WeChat, recently unveiled its 2019 figures. The company processed an average of over a billion commercial payments PER DAY, has 800 million active users and works with 50 million merchants.

To see the room for growth, one needs to look at the Indian cash and payments market. Nearly 95 percent of Indian transactions were in cash until late 2016 when a large denomination currency bill was suddenly withdrawn from circulation. And cash is still king. According to the Reserve Bank of India, cash in circulation in 2018 was only slightly down on 2014 (11.4% versus 11.2% of GDP).

Nonetheless, BIS statistics show that India has the highest growth rate in cashless payments in the world at 54.5% in 2018. However, UPI direct bank payments dominate and do not require a wallet.

Currently, the biggest Indian wallet providers are Paytm, Google, Walmart-owned PhonePe, and BHIM from the national payments firm.

Paytm is backed by Softbank and Ant Financial and already has 16 million merchants and 300 million wallets with 150 milllion active users. Two years after launching, by mid 2019, Google Pay had grown to 67 million active users with PhonePe at 55 million.

Paytm said it processed five billion transactions in 2019 and PhonePe had done 290 million by mid-2019. A far cry from Tencent’s a billion a day.

Turning to ecommerce, digital wallets account for only 25% of ecommerce transactions in India, according to JP Morgan figures, with card and bank transfers accounting for 49%. Even in ecommerce, 17% are paid for in cash, presumably on delivery.

If India goes digital to anything like the same degree as China, there’s massive room for growth.

But even more competition could be on the cards, as the National Payments Corporation of India (NPCI), which controls the UPI bank payment system, is also developing a blockchain solution. But it’s unclear whether this will be consumer-facing or not.

So what’s the Libra angle?

It’s possible that the Jio investment has nothing to do with Libra. But it’s hard to miss the potential benefits. One of the stated aims of Libra is financial inclusion and to use stablecoins and low cost payments to help micro businesses grow. Jio ticks the box.

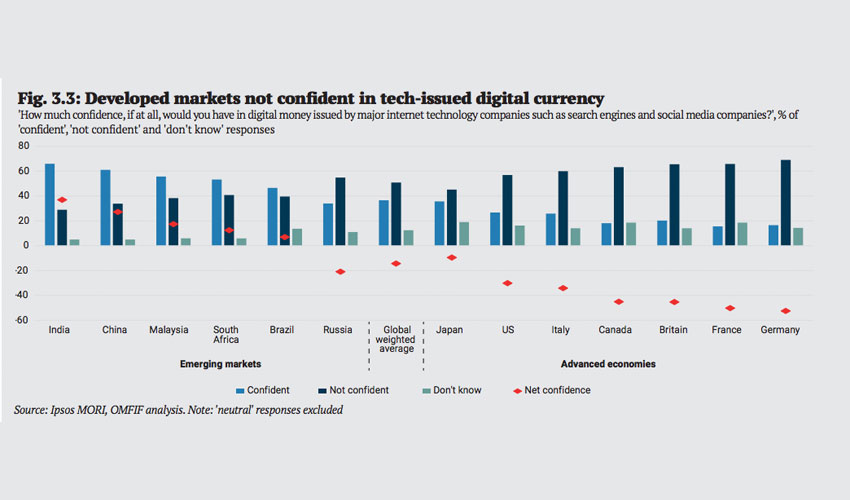

And unlike the West where big tech is distrusted, Indians would welcome a digital currency backed by a big tech firm, as found in a recent survey by central bank think tank OMFIF and Ipsos MORI.

When Libra was first unveiled, it had two massive ecommerce players, eBay and lesser known South American giant Mercado Libre. Both abandoned Libra. But just two months ago, Libra announced the addition of Shopify. And Shopify could offer cross border Indian ecommerce both for Indian buyers and sellers.

Given Libra’s stated aim of enabling frictionless payments, it could be used in India for local retail payments such as JioMart, p2p payments, and remittances. India is the world’s largest inbound remittance market accounting for $83.1 billion or 12% of the global figure in 2019, per World Bank figures.

One of the pushbacks that Libra has faced from regulators around the world relates to Know Your Customer (KYC). In India, some wallets don’t require KYC if they are limited to UPI bank payments. However, other wallets need clearance, but India has a national digital identity system Aadhaar which helps. In a recent report, the Reserve Bank of India noted that “Aadhaar enabled eKYC (electronic Know Your Customer) had resulted in an exponential growth of digital payments in India.”

This low friction KYC could make it easier to shift to a Calibra wallet, Facebook’s wallet for Libra.

Cryptocurrency restrictions lifted, but will it last?

Another potential advantage for Libra is cryptocurrency restrictions have been lifted in India. Sort of. The Reserve Bank of India issued a circular banning banks from providing services to cryptocurrency exchanges. Two months ago, the Supreme Court overturned that ruling and cryptocurrency trading took off.

However, in February 2019, India published a Bill to ban cryptocurrencies. It remains to be seen whether this becomes legislation.

Meanwhile, the Reserve Bank of India (RBI) is exploring issuing a Rupee central bank digital currency (CBDC). A digital Rupee was also mentioned in India’s recently published draft National Strategy on Blockchain.

Based on Libra’s latest iteration, it plans to support CBDCs, so if in future Libra receives the go-ahead in India, Facebook’s Calibra could be in pole position, even if India launches a CBDC.