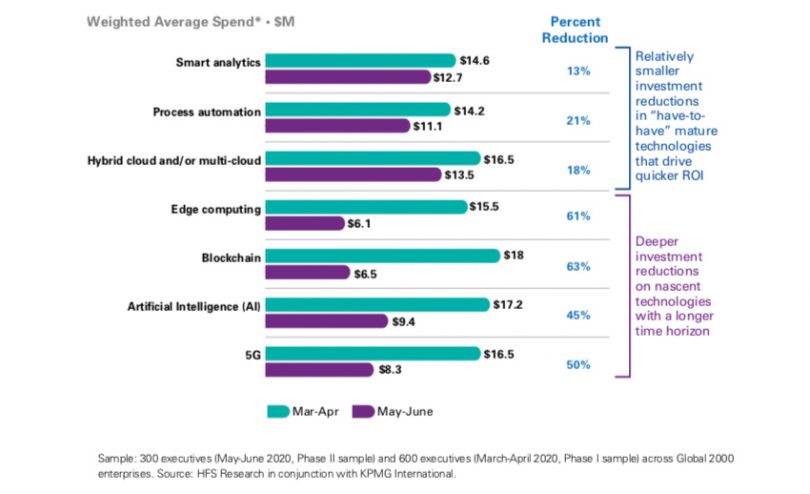

The KPMG and HFS Research “Enterprise reboot” survey found that in March / April the average budget for blockchain was $18 million. The figure dropped to $6.5 million in May / June. The survey targeted 900 technology executives at large enterprises for changes in emerging technology strategies triggered by COVID-19 .

The March figures had blockchain at the top of the pile budget-wise compared to six other emerging technologies. But by June, blockchain was second last and had the highest percentage drop of all seven technologies. Despite this, KPMG says its survey shows spending will increase in the next 12 months and the cuts are viewed as short term rather than permanent.

Perhaps more important than the rapid budget decline is to understand why blockchain has faired badly compared to other technologies. The answer seems to be that it’s not viewed as a quick win.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.