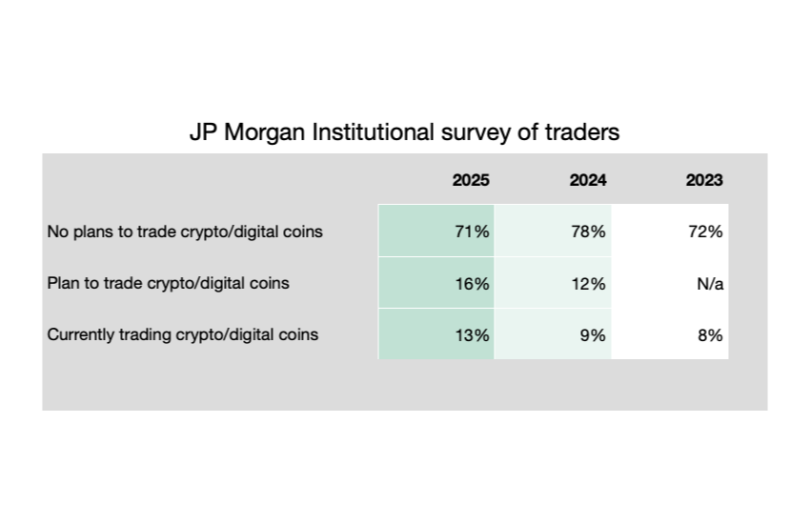

JP Morgan surveyed more than 4,200 institutional traders as part of its eTrading survey. Seventy one percent had no plans to trade cryptocurrencies, down from 78% last year. The number of active traders increased to 13% (9% in 2024).

The increase in active traders makes sense as it coincided with the launch of U.S. Bitcoin ETFs in January 2024, as well as an upswing in crypto prices – Bitcoin rose by more than 120% between the start and end of 2024. By contrast, 2023 was the post FTX recovery period.

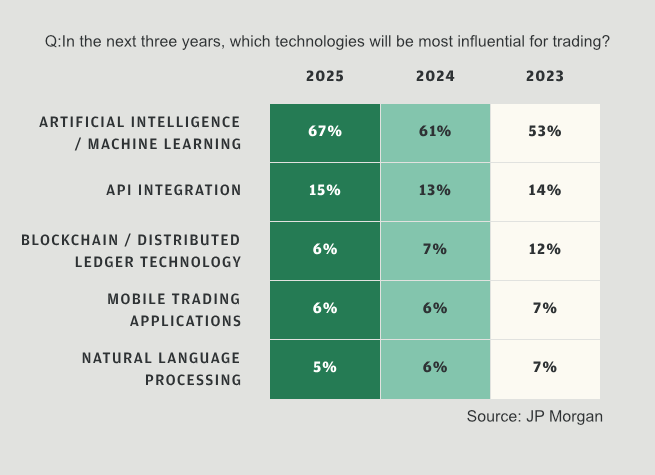

The question regarding the importance of various technologies showed that artificial intelligence extended its dominance, followed by APIs. Blockchain is still a distant third selected by 6%, down from 7% last year.

While tokenization should result in greater interest in blockchain technology, for tokenized conventional securities, it has a bigger impact on the back office rather than traders. For example, most tokenized bonds are currently traded in a conventional manner, even if ultimately settled on blockchain. Some of the larger digital securities platforms have integrated their blockchain offerings with legacy systems, so the trader might not care – or be aware – they are trading a digital bond.

If there’s more of a move to permissionless blockchains, that could change. For example, in Europe, 21X is launching a regulated digital securities exchange with an on chain order book. For now, that’s still the exception for digital securities, rather than the norm.