A Bloomberg report yesterday stated that JP Morgan is exploring a blockchain-based deposit token for cross-border payments. It says the bank would not create the token without approval from U.S. regulators. We explore what type of deposit token this might be, given we believe the bank already has the go ahead.

JP Morgan plans to use the product for corporate client transactions within a year of receiving the go ahead. The report is based on a source, but a JP Morgan spokesperson added, “Should that appetite develop, our blockchain infrastructure would be able to support the launch of deposit tokens relatively quickly.”

While stablecoin reserves involve ringfenced assets and are pseudonymous, deposit tokens are simply digital versions of bank deposits, which always require KYC.

The key benefit of deposit tokens for cross border payments is the speed of cross border settlement and their 24/7 nature. Nowadays SWIFT payments are fast. But they often involve intermediaries and SWIFT only sends messages. So the recipient bank has to be open to make the actual payment, which is challenging across timezones. In contrast, with digital tokens there is no separation of the message and the money, and the transaction can happen irrespective of opening hours.

What type of deposit token?

A key question is what type of deposit token is the bank talking about, because it is not entirely clear in the Bloomberg report. We suspect this may be a public blockchain deposit token.

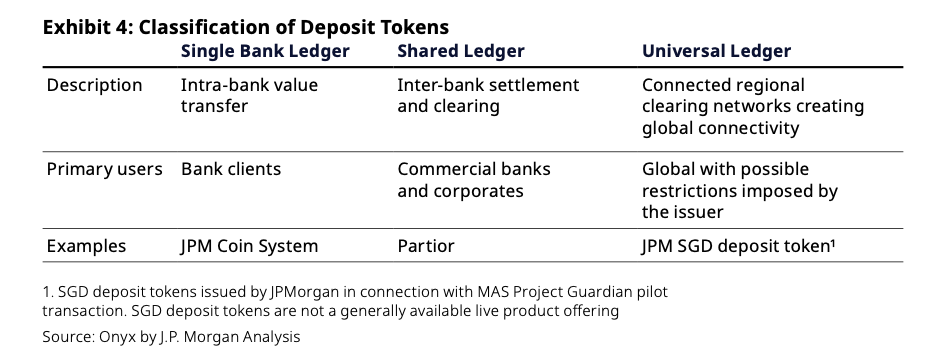

JP Morgan’s Onyx division talks about three types of deposit tokens. One is for payments within the bank (JPM Coin). Another is for interbank payments on a shared ledger (Partior). And the third is for interbank payments on a “universal” ledger or a public blockchain.

It already has JPM Coin, which it refers to as a blockchain-based deposit account. This purely supports payments between JP Morgan bank accounts but is used by large corporates for intra company transfers. The most recent statistic is that it processed $300 billion by June this year, when it launched a Euro blockchain deposit account.

JP Morgan has the OK for blockchain deposit tokens?

According to our information, in May JP Morgan received a non objection letter from the Office of the Comptroller of the Currency (OCC) to use the Partior network. Partior is an interbank deposit token network for cross border payments which aims to target corporate payments. Confirmed participant banks are DBS Bank and Standard Chartered. We believe Deutsche Bank and Japan’s SMBC are also joining the Partior network, although there has not been a formal announcement. In May, sources close to Deutsche Bank said no decision had been made.

If our information about the greenlight for Partior is accurate, then is the Bloomberg news about public blockchain tokens? Currently many regulators are far more cautious about public blockchains. The USDF Consortium has tried to get U.S. clearance for bank deposit tokens, and it switched from a public to private blockchain to appease regulators.

Onyx by JP Morgan already participated in a deposit token trial as part of the Monetary Authority of Singapore’s Project Guardian. That involved it issuing an SGD deposit token on a public blockchain (Polygon), which it exchanged with a JPY token from SBI Digital Asset Holdings.

Why now?

There are two potential reasons for highlighting JP Morgan’s plans now. Earlier this week, another deposit token initiative, the Regulated Liability Network (RLN), revealed it is running extending trials in the UK following a U.S. trial a few months back. Both trials attracted quite a bit of attention. Citi initiated the RLN.

A less likely motivation is the stablecoin legislation progressing in the United States. While deposit tokens are quite different from stablecoins, the current version of the legislation mentions deposit tokens indirectly.

It includes a clause stating the Stablecoin Act must not be construed as limiting the authority of banks and credit unions involved in:

(1) accepting or receiving deposits and issuing digital assets that represent deposits;

(2) utilizing a distributed ledger for the books and records of the entity and to affect intrabank transfers;

However, not limiting a bank’s authority is not the same as giving it permission. And for now, the OCC and Fed require banks to get the all clear before proceeding with deposit tokens.