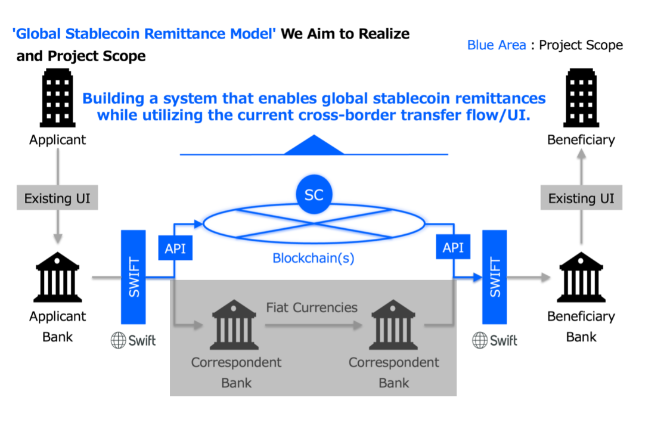

Japan’s big 3 banks, MUFG, SMBC and Mizuho are involved with with a cross border payment system, Project Pax, that aims to use stablecoins instead of correspondent banks. However, in order to ensure that corporate customers can trigger trade payments in the conventional manner via their banks, Swift payment messages will be integrated with the stablecoin system, which is based on Progmat. Hence, the clients don’t touch the stablecoins.

Given the efficiencies of stablecoin payments, the aim is to support 24/7 payments to address the G20’s goals for faster, cheaper, more transparent cross border payments. The total market capitalization of stablecoins has reached $170 billion with cryptocurrency as the primary use case, although they are also used for P2P payments.

Meanwhile, Progmat is a DLT-based tokenization network founded by MUFG, in which Mizuho and SMBC are joint venture partners alongside other institutions. Additionally, there’s a Progmat Coin solution which is primarily used for trust-based stablecoins, which have ring-fenced assets.

Progmat has been working with Datachain for some time on interoperability solutions to connect the permissioned Progmat network that uses the Corda enterprise blockchain with various permissionless networks. Those include Ethereum, Avalanche, Polygon and Cosmos. Additionally, Datachain founded TOKI a cross chain bridge that will run DeFi style liquidity pools for exchanging different currency and blockchain stablecoins. These solutions will be used as part of Project Pax, which is a joint venture between Progmat and Datachain.

Given the work that’s already been done, they aim to start testing a prototype ‘shortly’. The Pax members also plan to collaborate with other financial institutions in Japan and elsewhere, looking to go live by 2025.

Regarding the Swift integration, the messages will instruct payments to settle via blockchain networks. This is seen as addressing bank operational issues and removes the need for corporates to deal with the unfamiliar concepts of wallets and keys. Plus, it addresses AML and other compliance concerns.

Other stablecoin and DLT initiatives

Ledger Insights Research has published a report on bank-issued stablecoins and tokenized deposits featuring more than 70 projects. Find out more here.

Progmat already has several collaborations for stablecoin payments. Last year MUFG and DRW Cumberland started exploring JPY and USD stablecoins for institutional crypto settlement. This will involve the Japanese wallet provider Ginco issuing XJPY and XUSD stablecoins.

It also has a partnership with existing Japanese stablecoin JPYC and with Standage, a Japanese specialist in export settlement.

Stepping back, other DLT initiatives are targeting cross border payments. Of course, there is Ripple On Demand Liquidity solution that uses XRP as an intermediate currency and is used by remittance companies.

On the institutional side, JP Morgan, DBS Bank and Standard Chartered are involved in Partior that uses DLT to smooth the correspondent banking payment process. This enables banks that connect to the network to make cross border payments 24/7. While the client banks can make instant payments, the settlement banks still have to settle up between themselves, which they do in the conventional manner. Both SMBC and Mizuho have done some work with Partior.

More recently, the BIS launch Project Agorá which has similar goals to Partior. Its major advantage is the involvement of seven central banks that can provide wholesale CBDCs. This would sidestep Partior’s issue of the settlement banks needing to settle between themselves conventionally.

Project Pax is one of an ever expanding range of projects in the realm of stablecoins, tokenized deposits and DLT payments.