DeCurret DCP, the company behind the DCJPY tokenized deposit network, said it has started production testing of the network. It expects to go into production in August. DeCurret runs the Japanese Digital Currency Forum, which has more than a hundred corporate and government participants who are exploring a broad range of applications that use digital currencies for settlement. DeCurret also raised significant funding from several big names, including MUFG, SMBC and SBI Holdings.

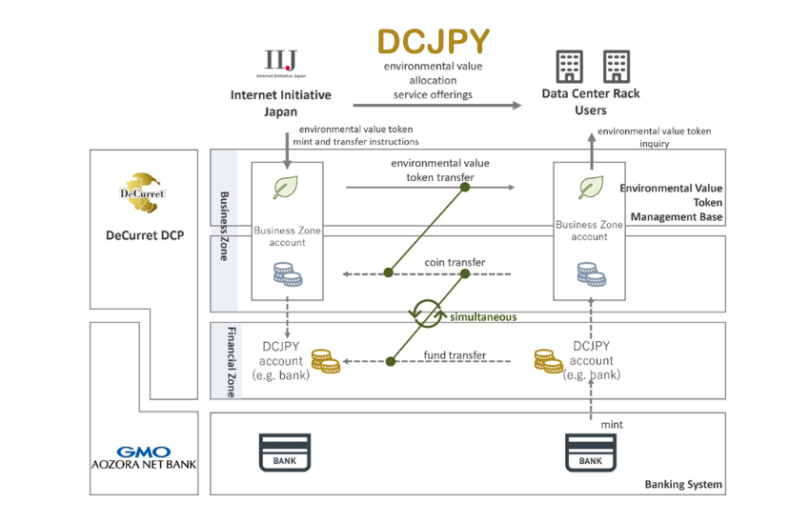

However, they are not participants in the first application, which uses on-chain bank deposits to pay for tokenized renewable energy certificates (RECs). The Internet Initiative Japan (IIJ) recently became a member of the Japan Electric Power Exchange (JEPX) to procure RECs on behalf of its data center clients. Now it plans to convert the RECs into digital tokens and settle transactions with tokenized deposits from GMO Aozora Net Bank.

In the future DeCurret DCP wants to expand the application by including electricity retailers, power companies and carbon trading exchanges.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.