Last week the Financial Services Agency (FSA) presented some ideas relating to cryptocurrency and stablecoins to the Financial System Council Working Group on Payment Services. The FSA is reluctant to allow banks to issue stablecoins other than trust banks. For trust bank issued stablecoins, it wants to relax the reserve requirements which currently require all assets to be held in bank demand deposits. However, it also wants to impose the travel rule, requiring KYC for trust bank issued stablecoin transfers.

Japan passed stablecoin legislation in 2022 that supported issuance by banks, licensed money transfer companies and trust companies. As part of its working group presentation, the FSA distinguished between stablecoins issued on permissioned blockchains and those on public blockchains. It’s comfortable with all three existing on permissioned chains. However, it is wary of allowing licensed deposit institutions to issue stablecoins on permissionless chains.

From the FSA’s perspective, for a bank to issue a permissionless stablecoin amounts to it issuing a demand liability that is not a deposit. It’s concerned about protecting depositors and financial stability. If something went wrong, it would be problematic to apply the deposit insurance system given the liability is not a deposit. It says that there is little demand in Japan for this type of stablecoin so far.

Japanese banks interested in stablecoins

However, based on our research (we published a report) one bank (Hokkoku) has issued a ‘stablecoin’ on a permissioned blockchain (that’s allowed). Sony Bank has experimented on a public blockchain (Polygon). However, when we reported on Sony’s trials, we observed it might involve a collaboration with Sumitomo Mitsui Trust Bank (SuMi Trust) so it may be a trust-issued coin. Some other banks are exploring stablecoins with G.U. Technologies on a Japanese blockchain which might be considered public but permissioned. That one could be a gray area.

The FSA noted that the EU allows banks to issue stablecoins; the UK does not (under the same brand), and the US has yet to issue legislation. We’d note that U.S. banks have to get any DLT activities approved by banking regulators, which has slowed down permissioned blockchain activities, never mind permissionless.

Trust bank stablecoin reserves

As part of the working group discussion, the FSA noted that currently trust bank stablecoin reserves are expected to be managed as demand deposits with banks. Japan passed stablecoin legislation in 2022, before most other jurisdictions.

These other countries often allow stablecoin reserves to comprise other assets, particularly government bonds. “In order to avoid undermining the competitiveness of domestic businesses in the global market, it may be necessary to consider equal footing with other jurisdictions and promote flexibility in the management and operation of issuance matching funds,” the FSA said.

However, it noted from the point of view of price stability of the stablecoin and ease of redemption, deposits work well. So if it is going to relax the requirements, assets must have low credit and liquidity risk with stable prices.

Hence, it considers that government bonds should be allowed. For the yen it wants Japanese bonds with up to three months maturity. And it’s inclined to do the same for the US dollar / US Treasuries. Even with 90 day maturities, there’s a possibility of price fluctuations in government bonds. Japanese law prohibits trustees compensating for losses so it’s considering obligating the trust settlor (the stablecoin ‘brand’) to compensate for any losses.

Bank time deposits (versus demand deposits) could also be considered, provided they can be redeemed before maturity.

The FSA proposed that the combination of government bonds and time deposits might have an upper limit of 50% of reserves. The EU has a limit of 70% for stablecoins and 40% for larger stablecoins.

Trust bank stablecoins and travel rule?

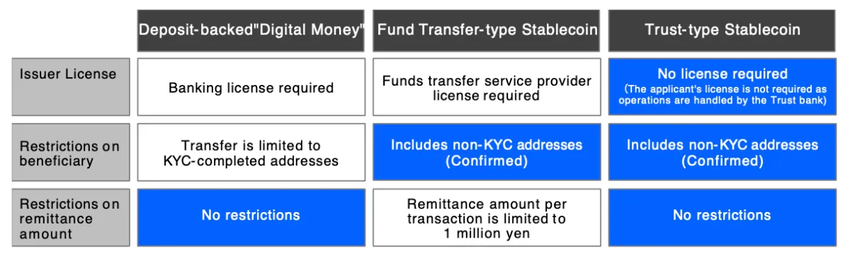

MUFG-founded Progmat Coin has big plans for trust based stablecoins and assumes that transfers without KYC are allowed. Progmat published the graphic below late last year. It has a collaboration with Binance, the world’s largest crypto exchange.

According to the FSA, a 2022 law introduced the travel rule for intermediaries to notify sender and recipient information. It said it expected trust beneficiary rights holders (trust stablecoins) to have a register which would be updated for transfers. That’s why trust stablecoins were excluded from travel rule requirements. However, with public blockchains there is no register of rights. Hence, it’s considering imposing the travel rule on trust-style stablecoins.

It depends on how this is done. If the travel rule is the responsibility of the intermediaries, that’s the norm worldwide. A bigger question is what about peer-to-peer transfers without intermediaries?