A recent survey of the incumbent securities sector shows a dramatic increase in live DLT deployments. Currently, 32% of organizations surveyed have production projects compared to 8% last year. Another 32% of firms are in the build phase towards production. The survey of 148 incumbents was conducted on behalf of the International Security Services Association (ISSA).

A shift in DLT asset class priority

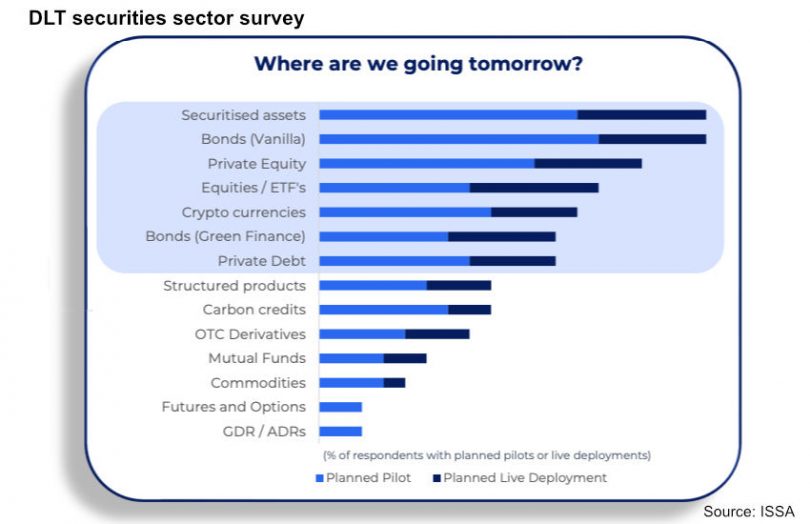

Over time there’s been a shift in focus between assets classes, evolving beyond the current emphasis on cryptocurrency and bond issuance. While cryptocurrency currently ranks top in terms of live deployments, it drops to the fifth spot in plans. The top spot for planned solutions is securitized assets, followed by bonds and private equity.

“DLT is clearly starting to deliver real results for the industry today and tokenising highly paper-based assets – such as securitised assets, mutual funds and private debt – is clearly yielding positive returns in 2022,” said Colin Parry, CEO of ISSA.

However, interest in deploying cryptocurrency has not dropped across the board. For example, it’s still the number one asset class for custodians and banks, with bonds and payments/FX next most popular. In contrast, brokers and institutional investors are slightly less engaged with distributed ledger technology and earlier in the process. Still, securitized assets rank in the top three asset classes for both groups.

The importance of securitized assets to investors is easy to explain. Conventional approaches provide very tardy visibility into the underlying performance of mortgage-backed securities and other securitized lending. Why wait six weeks to find out if the default rate is ratcheting up when you can find out within a day? Blockchain solutions from Intain and Liquid Mortgage are tackling these sorts of issues and being deployed at scale, including a recent $313 million securitization from a Redwood Trust subsidiary.

Whether organizations favor public or private blockchains also depends on the asset class. Apart from cryptocurrencies, public blockchains are favored for securitized assets, structured products and private debt.

Each sub-sector has different motivations for deploying blockchain. Exchanges, CSDs, custodians and banks see opportunities for new product launches. Whereas brokers, investment banks, and institutional investors are currently focused on internal efficiencies, such as securitization reporting.

Geographic differences

Organizations in APAC are generally more advanced in engaging with blockchain. It had the highest deployment percentage at 34%, with the Americas as laggards at 13%. However, the Americas are in an aggressive growth phase, ahead of other regions in the pre-launch build phase. Europe was just behind APAC in terms of live deployments, but the proportion of projects in the build phase is significantly behind the Americas and APAC.

Meanwhile, the Federal Reserve recently conducted a bank survey, which showed a surprisingly low adoption rate of the DLT.